Best Home Warranty Insurance Quotes for 2025

Home warranty insurance provides homeowners with peace of mind by covering the costs of repairing or replacing major systems and appliances in their home. As we look ahead to 2025, the home warranty landscape has evolved with new offerings, better customer support, and tailored coverage plans to meet different homeowner needs. Finding the best home warranty insurance quotes can make a big difference in your financial protection. In this article, we will explore some of the top providers, the most competitive quotes, and the coverage options available for 2025.

Why Consider Home Warranty Insurance?

A home warranty insurance plan is an agreement between a homeowner and a provider that covers the repair or replacement of household systems and appliances when they break down due to normal wear and tear. This type of insurance is essential for both new and existing homeowners because it helps reduce out-of-pocket expenses for unexpected breakdowns, especially for older homes.

Without a home warranty plan, homeowners may have to cover the full cost of repairs, which can be substantial depending on the type of appliance or system. A well-chosen home warranty plan offers both financial security and convenience by having pre-approved contractors handle the repairs.

Best Home Warranty Providers for 2025

Several home warranty companies stand out in 2025 based on customer service, coverage options, pricing, and reliability. Here are some of the top providers:

| Provider | Annual Cost | Service Fee | Coverage | Best For |

|---|---|---|---|---|

| American Home Shield | $450 - $900 | $75 - $125 | Covers appliances and systems, offers customizable plans for homeowners looking to tailor coverage to specific needs. Provides a generous coverage cap on home systems and appliances. | Comprehensive Coverage |

| Choice Home Warranty | $400 - $600 | $85 | Covers essential home systems and appliances, such as HVAC, electrical, plumbing, and major kitchen appliances. Includes a 30-day free trial and a reliable customer service network. | Best Value |

| Select Home Warranty | $400 - $750 | $60 - $100 | Offers both appliance and system coverage, with additional add-ons like pool and spa coverage. Provides a user-friendly claims process and affordable service fees. | Budget-Friendly Option |

| Cinch Home Services | $500 - $800 | $100 - $150 | Covers HVAC, plumbing, electrical systems, kitchen appliances, and more. Offers a variety of plans and includes emergency service for urgent repairs, with a focus on quick response times and a generous reimbursement policy. | Best for Quick Response |

| Liberty Home Guard | $500 - $800 | $60 - $125 | Offers extensive appliance and system coverage with extra options like pest control, electronics coverage, and roof leak repairs. The company has excellent customer service and high customer ratings. | Best for Add-Ons |

| First American | $350 - $600 | $75 - $100 | Covers home systems and appliances, including plumbing, HVAC, electrical, and kitchen appliances. First American also provides additional coverage for pre-existing conditions and no coverage limits for certain repairs. | Best for Older Homes |

Factors to Consider When Choosing a Home Warranty Plan

Selecting the right home warranty plan requires more than just looking at the price tag. Here are a few key factors to consider:

1. Coverage

Not all home warranty plans are created equal. Some providers offer coverage for both appliances and home systems, while others specialize in only one category. Additionally, certain plans allow for add-ons like pool coverage, roof leak repairs, or pest control, which can be valuable for homeowners with specific needs.

2. Service Fees

Service fees, or trade call fees, are the costs you must pay each time a technician comes to your home for a repair or replacement. Lower service fees can be attractive, but they may come with higher monthly or annual premiums. It's important to find a balance between service fees and premium costs.

3. Reputation and Customer Service

Customer service is a critical factor when selecting a home warranty provider. Reading reviews and checking ratings on platforms like the Better Business Bureau (BBB) can help you gauge how well a company responds to claims and how quickly they resolve issues. Timely service and professionalism are key when dealing with appliance or system breakdowns.

4. Exclusions and Coverage Caps

Before committing to a plan, carefully review the exclusions and coverage caps. Some plans may have limits on how much they will pay out for certain repairs or replacements, which could leave homeowners paying out of pocket for part of the repair costs.

5. Customizable Plans

If you want more control over your coverage, look for providers that offer customizable plans. These allow homeowners to pick and choose the systems or appliances they want to protect, ensuring they only pay for what they need.

Conclusion

Home warranty insurance is a valuable investment that provides financial protection and convenience for homeowners. As 2025 approaches, top providers like American Home Shield, Choice Home Warranty, and Liberty Home Guard offer a range of plans that cater to different needs and budgets. When comparing quotes, be sure to consider the coverage offered, service fees, reputation, and any additional benefits or customizations available.

With the right home warranty insurance plan, homeowners can enjoy peace of mind, knowing that their home’s systems and appliances are covered in case of unexpected breakdowns. Whether you’re a first-time homebuyer or a seasoned homeowner, it’s worth exploring these top home warranty providers for the best coverage and value in 2025.

Explore

Best Car Insurance Quotes 2025: A Comprehensive Guide

Window Replacement Options: Choosing the Best for Your Home

Best Health Insurance in the USA: A Comprehensive Guide

Best Life Insurance 2025 in the USA

Best Commercial Vehicle Insurance in 2025: A Comprehensive Guide

How to Get a Travel Insurance Quote Online

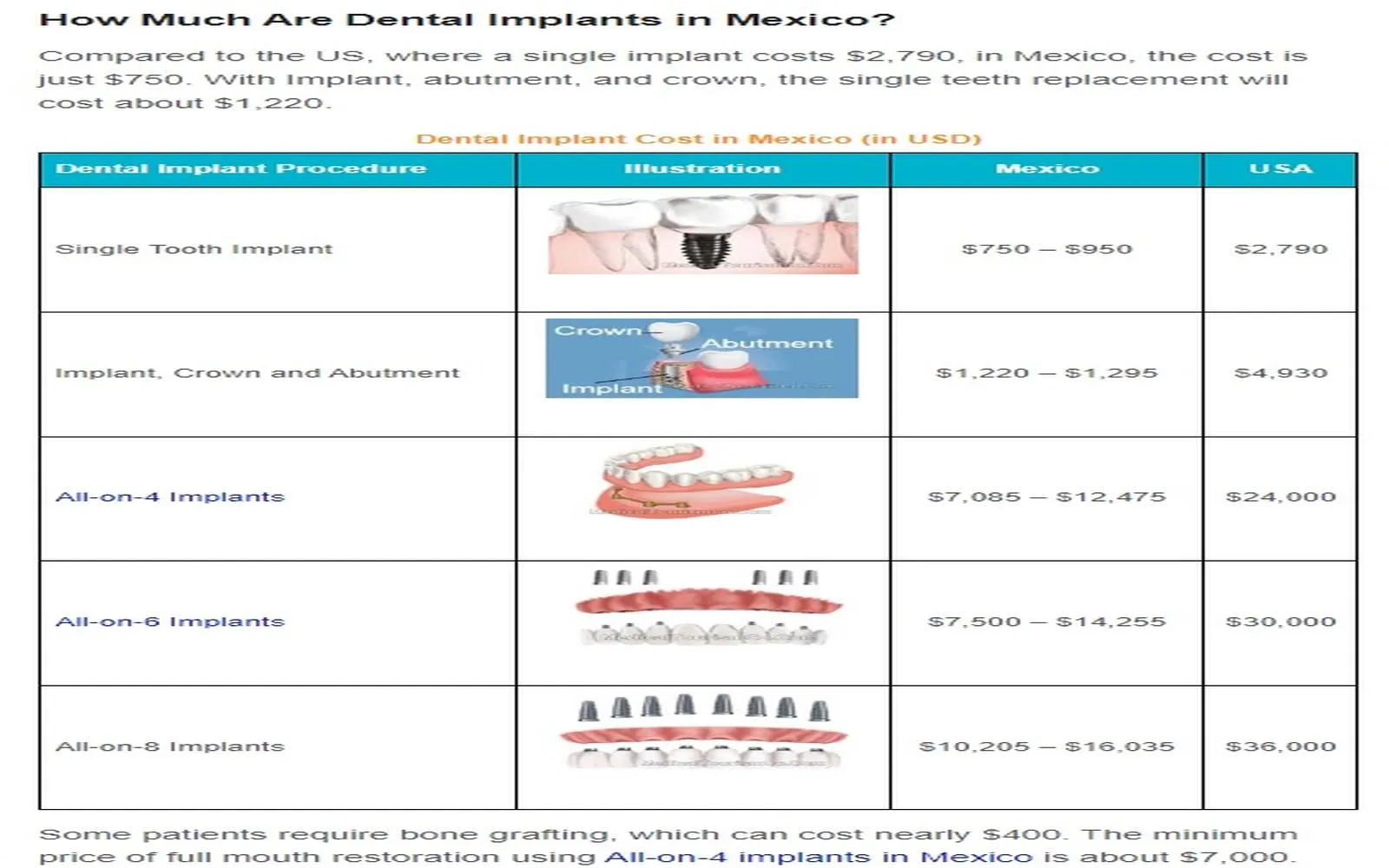

Dental Insurance That Covers Implants: Everything You Need to Know

Understanding Pet Insurance: Protecting Your Furry Family Members