Best Car Insurance Quotes 2025: A Comprehensive Guide

In 2025, finding the best car insurance quote has become more streamlined thanks to the advancement of digital platforms. However, with the wide variety of policies, coverage levels, and premium rates available, selecting the right option requires a thoughtful approach. Whether you're a new driver, a seasoned motorist, or someone looking to switch providers, this guide will walk you through key factors to consider when searching for the best car insurance quotes in 2025.

Key Factors Influencing Car Insurance Quotes

When obtaining car insurance quotes, insurers take multiple factors into account. Here are the most significant ones:

- Driving Record: Insurers examine your past driving history to assess the level of risk. Drivers with clean records typically receive lower rates, while those with accidents or violations may pay higher premiums.

- Vehicle Type: The make, model, and year of your car play a role in determining premiums. Expensive or high-performance vehicles usually come with higher rates due to their increased repair or replacement costs.

- Location: Urban areas often have higher rates due to increased traffic congestion and a higher likelihood of theft or accidents.

- Credit Score: In some regions, insurers may use your credit score as a factor in determining your rates, assuming that higher credit scores correlate with lower risk.

- Coverage Options: The level of coverage you choose, such as comprehensive, liability, or collision insurance, will impact your premium.

- Discounts: Many providers offer discounts based on factors such as bundling policies, safe driving, low mileage, or being a student or senior citizen.

Top Car Insurance Providers in 2025

Here are some of the best car insurance providers in 2025, each offering competitive quotes and coverage options.

| Insurance Company | Coverage Options | Average Annual Premium | Discounts Available | Customer Satisfaction Rating (out of 5) |

|---|---|---|---|---|

| State Farm | Liability, Collision, Comprehensive, Roadside Assistance, Rental Reimbursement | $1,300 | Safe Driver, Bundling, Good Student | 4.7 |

| Geico | Liability, Collision, Comprehensive, Mechanical Breakdown, Emergency Road Service | $1,250 | Defensive Driving, Military, Multi-Policy | 4.6 |

| Progressive | Liability, Collision, Comprehensive, Custom Parts Coverage, Rideshare Insurance | $1,370 | Homeowners, Safe Driver, Snapshot Program | 4.5 |

| Allstate | Liability, Collision, Comprehensive, Rental Reimbursement, Accident Forgiveness | $1,400 | Early Signing, Anti-theft Devices, Bundling | 4.4 |

| USAA (Military Only) | Liability, Collision, Comprehensive, Rideshare Insurance | $1,200 | Military Discounts, Safe Driving | 4.9 |

1. State Farm

State Farm remains a top choice for car insurance in 2025 due to its broad range of coverage options and high customer satisfaction. With an average annual premium of $1,300, it provides competitive rates and excellent discounts for safe drivers, good students, and those bundling multiple policies. Additionally, their claims service is highly rated, making State Farm a strong contender for those who prioritize reliability and customer service.

2. Geico

Geico is known for its affordable premiums, with the average annual premium sitting at $1,250. Geico offers a variety of discounts, including for military personnel, defensive drivers, and those who insure multiple vehicles or have home insurance through Geico. It’s a great choice for budget-conscious drivers who want reliable coverage without breaking the bank.

3. Progressive

Progressive offers several unique coverage options, including rideshare insurance and custom parts coverage, making it an excellent choice for individuals with specific insurance needs. Progressive's average annual premium is $1,370. Its Snapshot program allows drivers to potentially lower their rates by using a device that monitors driving behavior. Progressive is a solid option for tech-savvy drivers seeking flexible options.

4. Allstate

Allstate is ideal for drivers who want comprehensive coverage and additional perks like accident forgiveness and rental reimbursement. With an average annual premium of $1,400, Allstate offers more extensive coverage options and discounts such as anti-theft devices and early signing discounts. Although the premiums are slightly higher, the added benefits make it worthwhile for many drivers.

5. USAA

USAA stands out as the best option for military personnel and their families. With an average annual premium of $1,200, it offers some of the lowest rates available along with excellent customer satisfaction ratings. USAA’s discounts cater specifically to military members, such as savings for those who store their vehicles while deployed.

How to Get the Best Car Insurance Quote in 2025

Here are some actionable steps you can take to get the best car insurance quote in 2025:

- Compare Multiple Quotes: Always get quotes from several providers to ensure you’re getting the most competitive rate.

- Take Advantage of Discounts: Ask your insurance provider about potential discounts that could lower your premium.

- Adjust Your Coverage: Tailor your coverage to meet your needs. If you drive an older car, consider reducing comprehensive and collision coverage.

- Improve Your Credit Score: In regions where credit scores affect premiums, improving your score can help lower your insurance costs.

- Consider Usage-Based Programs: Many insurers offer programs that track driving habits to provide discounts based on your actual driving behavior.

Conclusion

In 2025, finding the best car insurance quote involves more than just selecting the lowest premium. Drivers should carefully consider their coverage needs, vehicle type, and potential discounts before making a decision. By comparing multiple quotes and leveraging discounts, you can secure a policy that offers both protection and affordability.

Whether you’re a new driver or looking to switch providers, understanding the factors that influence car insurance premiums will help you make an informed choice and get the best deal.

Explore

Best Home Warranty Insurance Quotes for 2025

Best Health Insurance in the USA: A Comprehensive Guide

Best Commercial Vehicle Insurance in 2025: A Comprehensive Guide

Best Car Accident Lawyers in the USA – 2025

The Best Internet Business Phone Systems: A Comprehensive Guide

How to Find a Good Slip and Fall Lawyer: A Comprehensive Guide

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

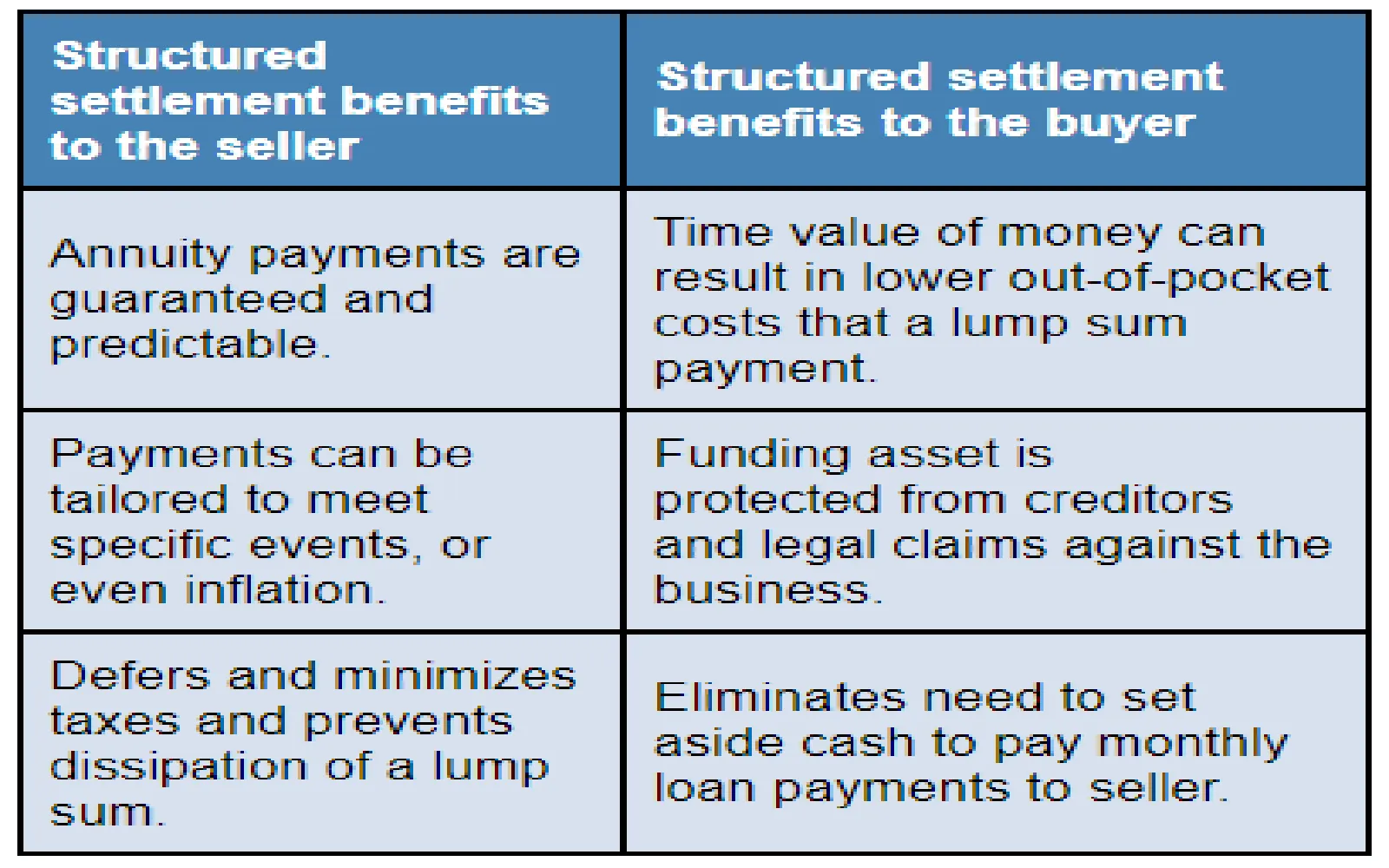

Understanding Structured Settlement Annuities: A Comprehensive Guide