Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

Tax debt is a common issue that many individuals and businesses face, often due to unforeseen circumstances such as financial hardship, poor financial planning, or simple errors in tax filings. If left unaddressed, tax debt can lead to severe consequences, including wage garnishments, liens, levies, and other legal actions by tax authorities. Fortunately, tax debt relief services offer a way for taxpayers to resolve their obligations and regain financial stability. This article explores the different aspects of tax debt relief, types of services available, and how to find the best solution for your situation.

Understanding Tax Debt

Tax debt occurs when individuals or businesses owe money to the federal or state government for unpaid taxes. This can be due to several reasons, including:

- Underreporting Income: Not reporting all sources of income.

- Filing Errors: Mistakes made while filing tax returns.

- Failure to Pay: Not paying the full amount due by the deadline.

- Changes in Circumstances: Financial difficulties or unforeseen life events.

Tax debt can accumulate quickly due to interest and penalties, making it harder to pay off the amount due over time. As the debt grows, tax authorities such as the IRS may take legal action to collect the debt, which is why seeking professional assistance is crucial.

Tax Debt Relief Services: An Overview

Tax debt relief services help taxpayers find solutions to reduce or eliminate their tax obligations. These services are provided by tax relief companies, certified tax professionals, and attorneys who specialize in negotiating with tax authorities to reach a settlement that is more manageable for the taxpayer. Here are the primary forms of tax debt relief available:

1. Offer in Compromise (OIC)

An Offer in Compromise allows taxpayers to settle their tax debt for less than the total amount owed. This program is available through the IRS and state tax agencies. To qualify for an OIC, taxpayers must demonstrate that paying the full amount would cause financial hardship and that they are unable to pay their taxes in full.

Benefits of OIC:

- Reduces the overall tax debt.

- Provides a fresh start for taxpayers struggling with large tax burdens.

Eligibility Criteria:

- Inability to pay the full amount.

- Unlikely to be able to pay in the future.

- Proof of financial hardship.

2. Installment Agreements

An installment agreement allows taxpayers to pay their tax debt over time in manageable monthly payments. The IRS offers different types of installment agreements based on the amount of debt owed and the taxpayer’s financial situation.

Benefits of Installment Agreements:

- Monthly payments are set based on the taxpayer’s ability to pay.

- Prevents wage garnishments and levies if agreed upon.

Eligibility Criteria:

- Outstanding tax debt of $50,000 or less (for individual taxpayers).

- A history of compliance with tax filings.

3. Currently Not Collectible Status

If a taxpayer is experiencing financial hardship and cannot afford to make any payments, the IRS may place the taxpayer’s account in "Currently Not Collectible" status. While this does not reduce the debt, it temporarily halts collection actions, such as wage garnishments and bank levies.

Benefits of Currently Not Collectible:

- Relief from aggressive collection actions.

- Allows taxpayers time to improve their financial situation.

Eligibility Criteria:

- Financial hardship with no ability to pay.

- Limited or no income or assets.

4. Penalty Abatement

Penalty abatement is a process by which taxpayers can request the removal or reduction of penalties that have been assessed on their tax debt. The IRS may approve penalty abatement if the taxpayer can show reasonable cause for the failure to file or pay taxes.

Benefits of Penalty Abatement:

- Reduces overall tax liability.

- Removes penalties that can significantly increase the debt.

Eligibility Criteria:

- Reasonable cause for non-payment (e.g., illness, natural disasters, or other mitigating factors).

- A clean history of compliance with tax obligations.

Choosing the Right Tax Debt Relief Service

When selecting a tax debt relief service, it’s important to research and consider several factors:

| Factor | Consideration |

|---|---|

| Experience and Reputation | Look for firms or professionals with a strong track record and good reviews. |

| Transparency | Ensure they provide clear pricing and explain the process upfront. |

| Specialization | Choose a service that specializes in tax debt relief and has experience negotiating with tax authorities. |

| Legal Expertise | If necessary, opt for a service that includes tax attorneys to help with complex cases. |

| Cost | Compare fees and make sure they fit within your budget while providing quality service. |

Benefits of Tax Debt Relief Services

- Expert Negotiation: Tax professionals are experienced in negotiating with tax agencies and know the ins and outs of the tax laws, which can result in more favorable outcomes.

- Reduced Stress: Working with professionals helps alleviate the stress of dealing directly with the IRS or state tax authorities.

- Protection from Collection Actions: Many tax relief services can halt aggressive actions like wage garnishments and levies during the resolution process.

Conclusion

Tax debt can be overwhelming, but it doesn’t have to dictate your financial future. Tax debt relief services provide a way for individuals and businesses to reduce or eliminate their obligations. Whether through an Offer in Compromise, installment agreements, or penalty abatements, there are options available to resolve your tax debt. By choosing the right service, you can regain control of your finances and move forward with confidence.

Before proceeding, it's essential to carefully evaluate your options and consult with a tax relief expert to determine the best course of action for your unique situation.

Explore

Maximizing Your Tax Return: A Guide to Boosting Your Refund

Best Managed IT Service Providers for 2025

Personal Loans for Debt Consolidation: A Smart Financial Move

The Best Internet Business Phone Systems: A Comprehensive Guide

How to Find a Good Slip and Fall Lawyer: A Comprehensive Guide

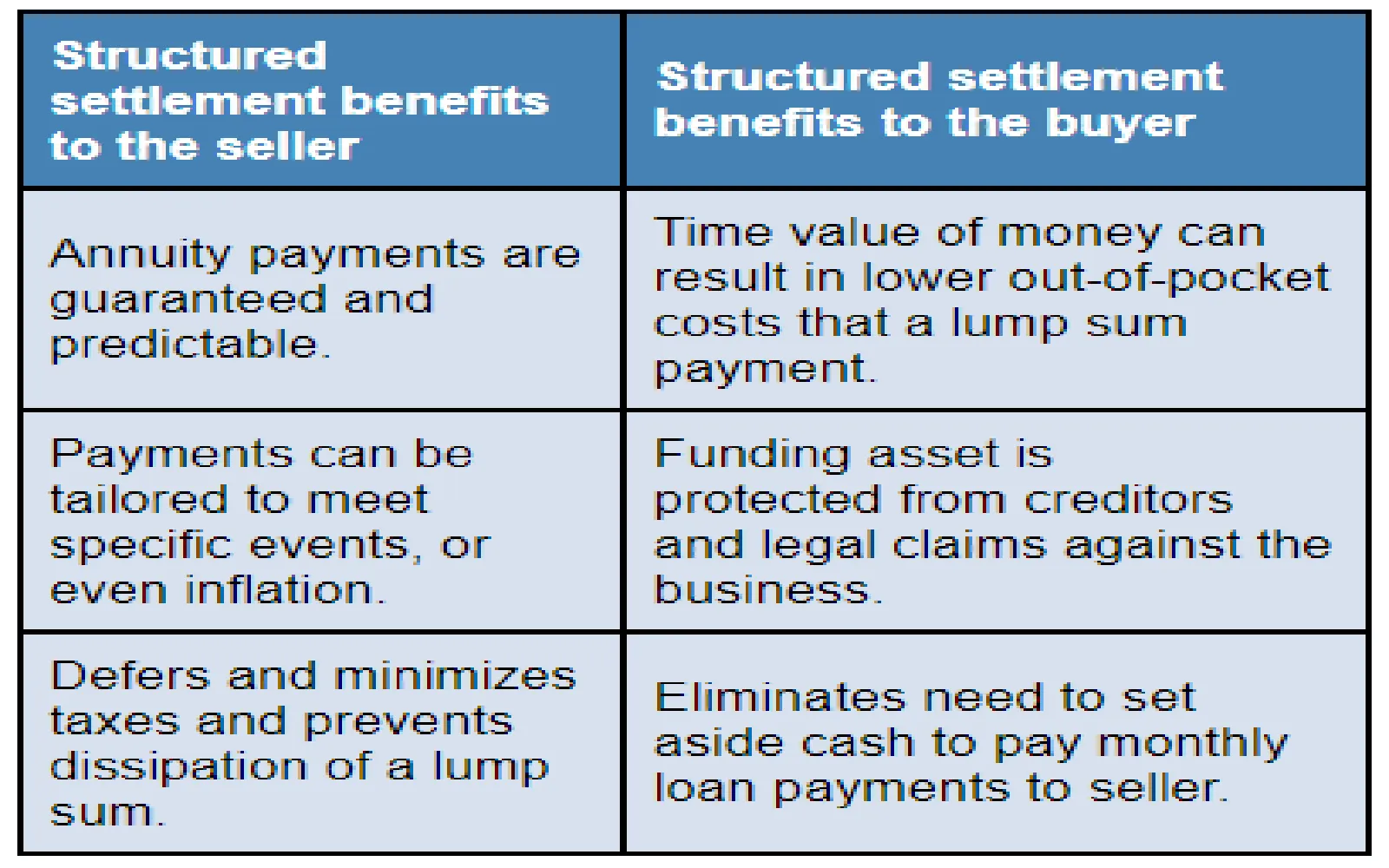

Understanding Structured Settlement Annuities: A Comprehensive Guide

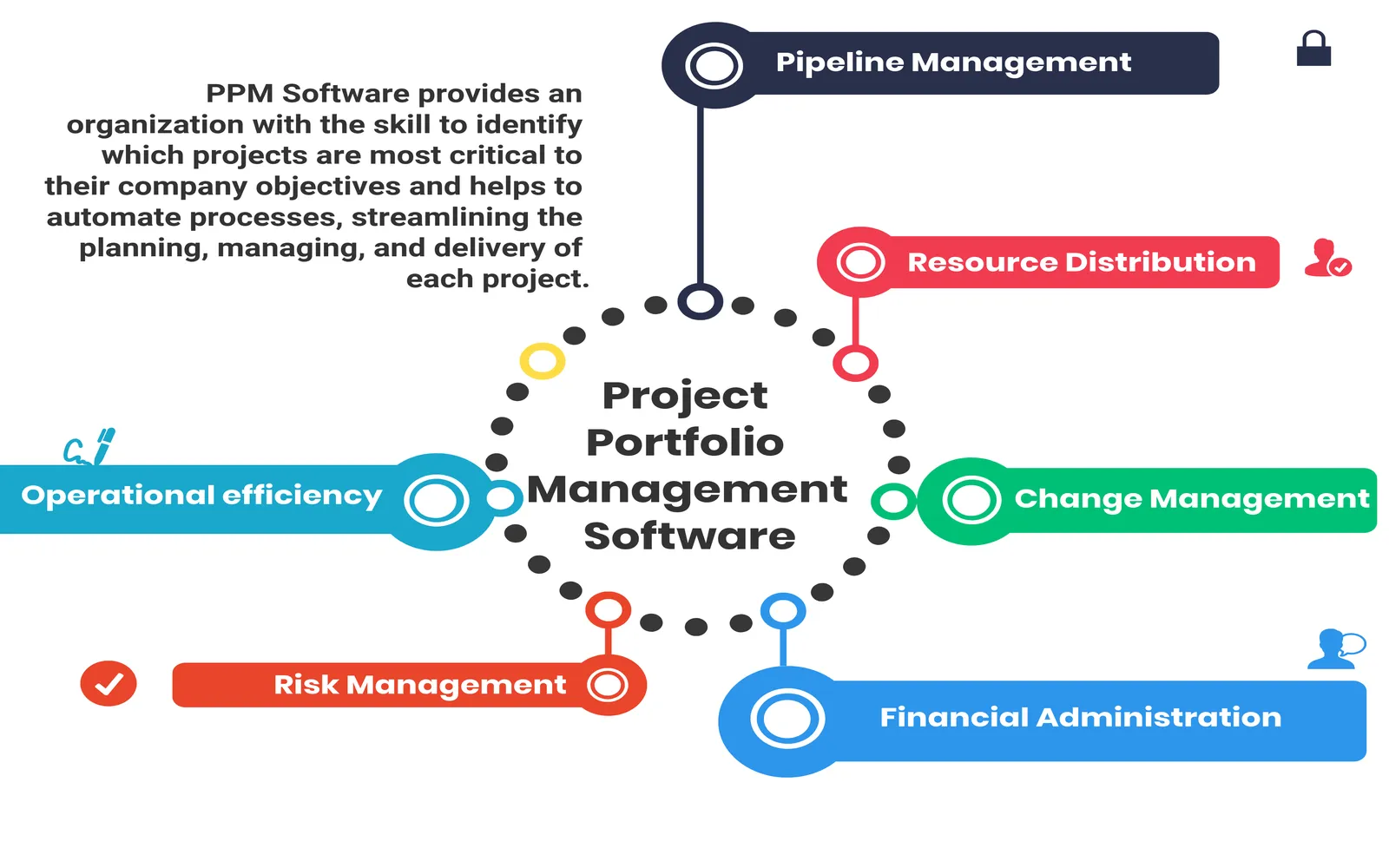

Best Project Portfolio Management Software: A Comprehensive Guide

How to Choose the Right Divorce Attorney: A Comprehensive Guide