Best Commercial Vehicle Insurance in 2025: A Comprehensive Guide

In 2025, commercial vehicle insurance has become a crucial component for businesses of all sizes, whether it's a large logistics company with a fleet of trucks or a small business owner with a delivery van. The need for comprehensive and reliable coverage is vital to protect against accidents, theft, and potential liabilities. This article will explore some of the best commercial vehicle insurance options available in 2025, covering their features, benefits, and ideal customer profiles. For ease of understanding, the information is also presented in tables, breaking down the key elements of each insurer’s offering.

Why Commercial Vehicle Insurance Is Important

Commercial vehicle insurance covers businesses from financial losses related to their vehicles. Unlike personal auto insurance, commercial policies cater specifically to vehicles used for business purposes. These policies typically cover a wide range of vehicle types, from sedans to trucks, trailers, and specialized vehicles.

Here are the main benefits of commercial vehicle insurance:

- Liability Protection: Covers costs associated with damage or injuries caused by your business vehicle.

- Comprehensive Coverage: Protects against theft, vandalism, and non-collision damages.

- Collision Coverage: Helps cover repair costs after accidents.

- Uninsured Motorist Coverage: Protects when the other driver involved in an accident lacks adequate insurance.

- Cargo Insurance: A useful addition for businesses transporting goods.

Top Commercial Vehicle Insurance Providers in 2025

The following table highlights the key features of the best commercial vehicle insurance providers in 2025, helping you compare and make informed decisions:

| Provider | Coverage Options | Best For | Average Premium | Claims Process | Unique Features |

|---|---|---|---|---|---|

| Progressive | Liability, Comprehensive, Collision, Cargo | Fleets, Large businesses | $1,500 - $2,500/year | Online, Mobile App, Phone | Snapshot® program for monitoring driver behavior |

| GEICO | Liability, Collision, Comprehensive | Small to medium businesses | $1,000 - $2,000/year | Online, Fast-track for small claims | Affordable for small businesses, bundling discounts available |

| Nationwide | Liability, Uninsured Motorist, Comprehensive | Medium-sized businesses | $1,800 - $2,200/year | 24/7 online portal, agent support | Tailored coverage for specific industries like construction |

| The Hartford | Liability, Physical Damage, Hired Auto, Non-Owned | Large fleets, High-risk jobs | $2,000 - $3,000/year | In-app digital claims filing | Broad industry expertise, fleet management tools |

| State Farm | Liability, Medical Payments, Comprehensive | Owner-operators, Small fleets | $1,200 - $2,000/year | Phone, Agent support | Personal customer service, customizable coverage |

| Liberty Mutual | Liability, Physical Damage, Inland Marine | Specialized vehicles, Trucks | $1,700 - $2,400/year | Online, Mobile App, Phone | Specialized coverage for transport and logistics industries |

Top Features to Consider

1. Liability Coverage

Liability insurance is the most critical part of a commercial vehicle policy. It covers bodily injury and property damage if your vehicle is involved in an accident. All the providers listed above offer strong liability coverage options, with The Hartford and Liberty Mutual standing out for specialized industries.

2. Comprehensive and Collision

Comprehensive coverage helps repair or replace a vehicle damaged by something other than a collision, like theft, fire, or vandalism. Collision coverage pays for damage caused by accidents. GEICO and Progressive offer affordable comprehensive and collision packages for small businesses and owner-operators.

3. Uninsured/Underinsured Motorist Coverage

This coverage protects your business if one of your vehicles is hit by a driver without insurance or inadequate coverage. Nationwide excels in providing uninsured motorist protection, making it a go-to for businesses in high-traffic areas where the risk of accidents may be higher.

4. Cargo and Inland Marine Coverage

For businesses involved in transportation, cargo insurance is essential. It covers the goods being transported. Liberty Mutual provides strong cargo and inland marine coverage for businesses in the logistics sector, making it ideal for trucking companies.

Cost Considerations in 2025

The cost of commercial vehicle insurance depends on various factors:

- Vehicle type: Larger vehicles like trucks will generally have higher premiums than smaller cars or vans.

- Business size: Businesses with multiple vehicles will usually see discounts on fleet insurance, but the total premium will still be higher due to the number of vehicles.

- Risk factors: Businesses with high-risk jobs, like construction or transportation of hazardous materials, will pay higher premiums.

- Location: Insurance costs may vary based on regional regulations and accident rates.

The average annual premium for a small business with a single vehicle in 2025 can range from $1,000 to $2,500, depending on the coverage options chosen.

Additional Coverage Options to Explore

1. Hired and Non-Owned Auto Coverage

If your business uses rented vehicles or employee-owned vehicles, consider adding hired and non-owned auto insurance. This option, provided by The Hartford and Nationwide, extends liability coverage to vehicles not owned by your company but used for business purposes.

2. Fleet Management Tools

Some insurers, like The Hartford, offer fleet management tools that help monitor vehicle performance and driver behavior. These tools are especially beneficial for businesses managing large fleets and seeking to improve operational efficiency.

3. Bundling and Discounts

Many providers, including GEICO and State Farm, offer discounts for bundling multiple policies, such as general liability or property insurance, with vehicle coverage. This can significantly lower overall costs for businesses with diverse insurance needs.

Conclusion

Choosing the best commercial vehicle insurance in 2025 depends on your business size, vehicle types, industry, and risk factors. Progressive and GEICO are excellent choices for small and medium businesses looking for affordable, straightforward coverage. For large businesses with complex needs, The Hartford and Liberty Mutual stand out with their specialized policies and fleet management tools. Comparing coverage options, premiums, and customer service features will ensure your business gets the best protection while staying within budget.

Explore

Best Health Insurance in the USA: A Comprehensive Guide

Best Car Insurance Quotes 2025: A Comprehensive Guide

The Best Internet Business Phone Systems: A Comprehensive Guide

How to Find a Good Slip and Fall Lawyer: A Comprehensive Guide

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

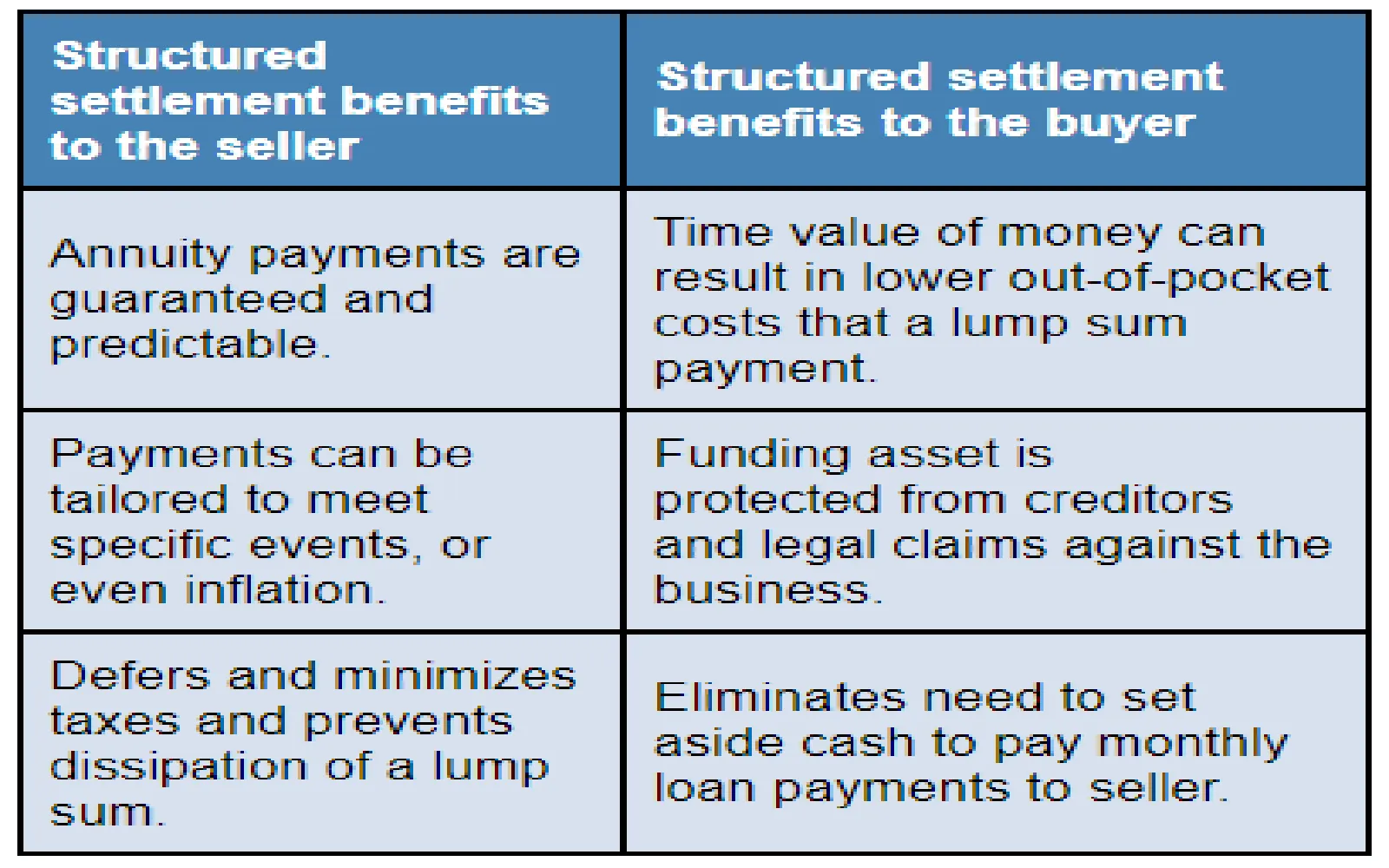

Understanding Structured Settlement Annuities: A Comprehensive Guide

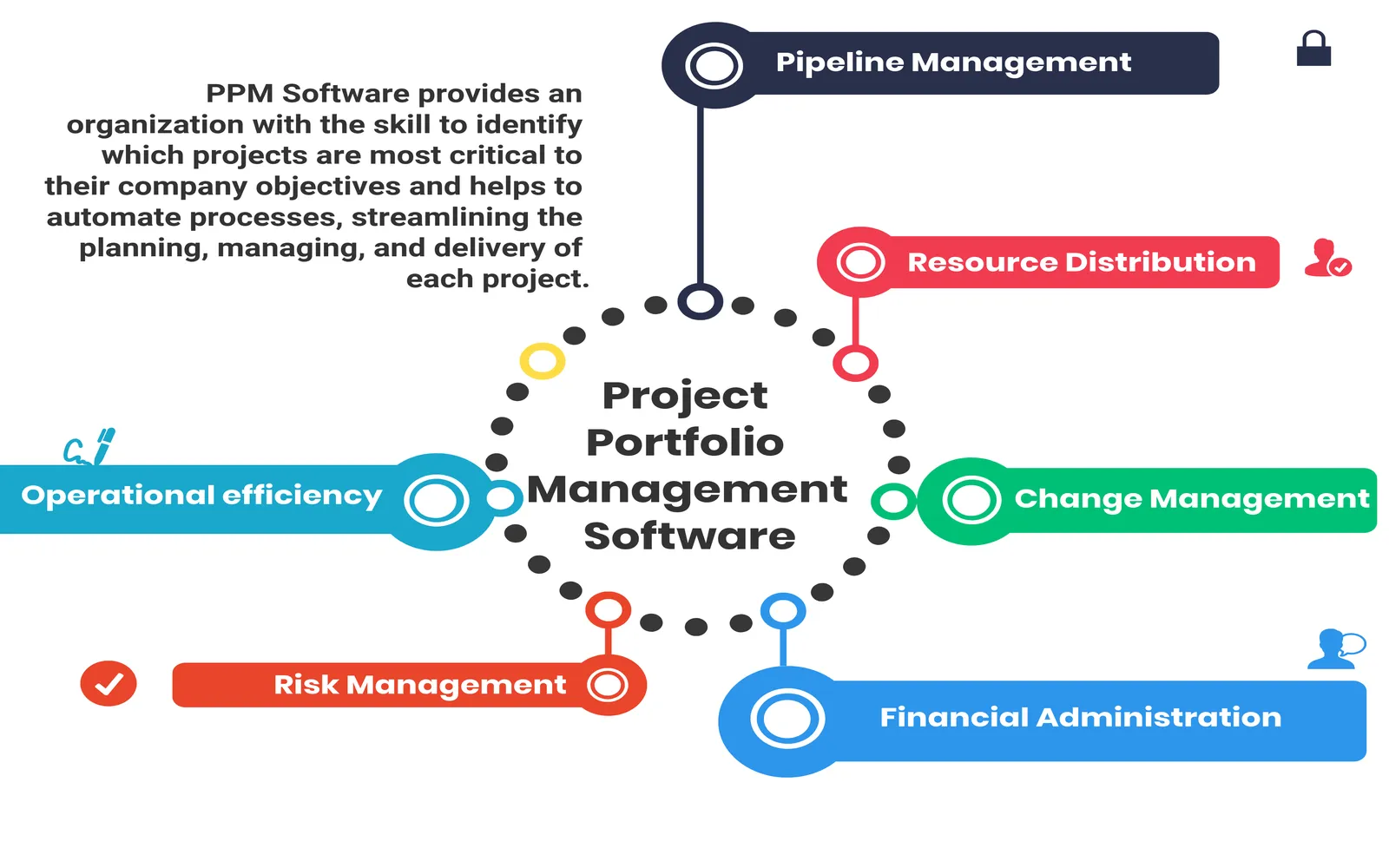

Best Project Portfolio Management Software: A Comprehensive Guide

How to Choose the Right Divorce Attorney: A Comprehensive Guide