Best Health Insurance in the USA: A Comprehensive Guide

Health insurance is a crucial investment in your well-being, providing financial protection against high medical costs. In the United States, health insurance is available through private companies, employers, and government programs. With numerous options, choosing the right health insurance plan can be overwhelming. This article will provide an overview of the best health insurance providers in the USA, highlighting key features, costs, and the types of plans they offer. This guide will help you make an informed decision based on your needs and budget.

1. Blue Cross Blue Shield (BCBS)

BCBS is one of the largest and most well-known health insurance providers in the United States. The company operates through 36 independent and locally operated companies, offering coverage in all 50 states.

| Key Features | Details |

|---|---|

| Plan Options | HMO, PPO, EPO, POS |

| Coverage | Nationwide network of over 1.7 million doctors and hospitals |

| Average Cost | $400–$600 per month for individual plans |

| Pros | Wide network, variety of plans, access to care in rural and urban areas |

| Cons | Higher premiums for comprehensive coverage, varying service quality depending on state |

BCBS provides flexibility in terms of plan types, from Health Maintenance Organization (HMO) plans with lower premiums to Preferred Provider Organization (PPO) plans offering more freedom in choosing healthcare providers. Their extensive network ensures easy access to care no matter where you live.

2. UnitedHealthcare

UnitedHealthcare is another top insurer, offering a wide range of plans through employer-sponsored insurance and the marketplace.

| Key Features | Details |

|---|---|

| Plan Options | HMO, PPO, EPO, POS |

| Coverage | Large network of healthcare providers, including dental and vision |

| Average Cost | $350–$500 per month for individual plans |

| Pros | User-friendly digital tools, wellness programs, nationwide coverage |

| Cons | Can be expensive without employer subsidies |

UnitedHealthcare is known for its focus on technology and customer service, with apps and tools to help you manage your healthcare more effectively. Additionally, they offer a variety of wellness programs, encouraging preventative care.

3. Kaiser Permanente

Kaiser Permanente is a nonprofit healthcare provider and insurance plan, well-known for its integrated care model.

| Key Features | Details |

|---|---|

| Plan Options | HMO |

| Coverage | Available in 8 states and Washington D.C. |

| Average Cost | $300–$500 per month for individual plans |

| Pros | Excellent care coordination, preventive services, low premiums |

| Cons | Limited to specific regions, HMO restrictions on providers |

Kaiser Permanente operates its own hospitals and healthcare facilities, offering a coordinated care approach that’s especially beneficial for individuals with chronic conditions. However, their coverage is limited to certain regions.

4. Aetna

Aetna is a popular choice for employer-based plans but also offers individual health plans on the marketplace.

| Key Features | Details |

|---|---|

| Plan Options | HMO, PPO, EPO |

| Coverage | Nationwide coverage with access to 1.2 million providers |

| Average Cost | $300–$550 per month for individual plans |

| Pros | Affordable premiums, wellness programs, telehealth services |

| Cons | Limited plan availability in some states |

Aetna stands out for its affordability and comprehensive wellness services, including mental health and telemedicine services, making it a good option for those seeking a balanced plan.

5. Cigna

Cigna offers a range of health insurance plans with a strong emphasis on international coverage and employee health plans.

| Key Features | Details |

|---|---|

| Plan Options | HMO, PPO, EPO |

| Coverage | Available in all 50 states, strong global network |

| Average Cost | $350–$600 per month for individual plans |

| Pros | Global coverage, extensive wellness programs, specialized plans for expatriates |

| Cons | Higher premiums for international plans, complex plan options |

Cigna is an excellent choice for individuals needing both domestic and international coverage, particularly for expatriates or frequent travelers. The company also offers various health management programs, such as weight loss, smoking cessation, and stress management.

6. Humana

Humana is particularly well-regarded for its Medicare Advantage plans, making it a strong option for seniors.

| Key Features | Details |

|---|---|

| Plan Options | HMO, PPO, Medicare Advantage |

| Coverage | Available in select states, focus on seniors |

| Average Cost | $200–$450 per month for Medicare plans |

| Pros | Affordable Medicare Advantage options, robust preventive care services |

| Cons | Limited individual plan offerings, not available in all states |

Humana’s Medicare Advantage plans often come with additional benefits like dental, vision, and prescription drug coverage. However, their individual health plan options are more limited compared to other major insurers.

Conclusion

Choosing the best health insurance plan in the USA depends on your personal healthcare needs, budget, and location. Whether you prioritize wide coverage, affordable premiums, or specialized services like preventive care or international coverage, there is a plan for everyone. The top insurance providers, such as Blue Cross Blue Shield, UnitedHealthcare, Kaiser Permanente, Aetna, Cigna, and Humana, each offer unique strengths. Take time to assess your needs, review plan details, and select the one that offers the best balance of coverage and cost for you.

By carefully comparing the options and understanding the differences in plan types (HMO, PPO, EPO, etc.), you can ensure that your health insurance provides the protection and peace of mind you need.

Explore

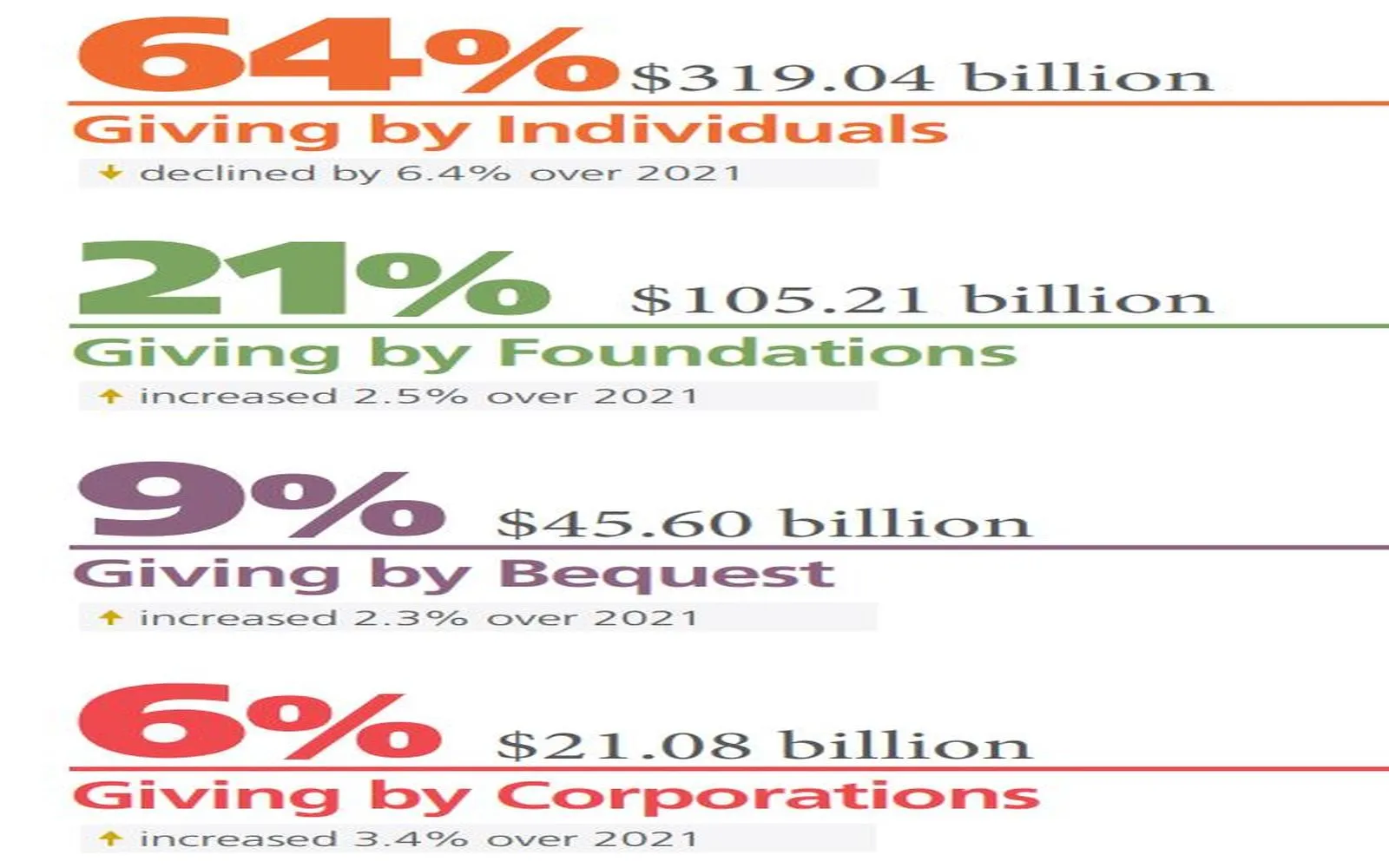

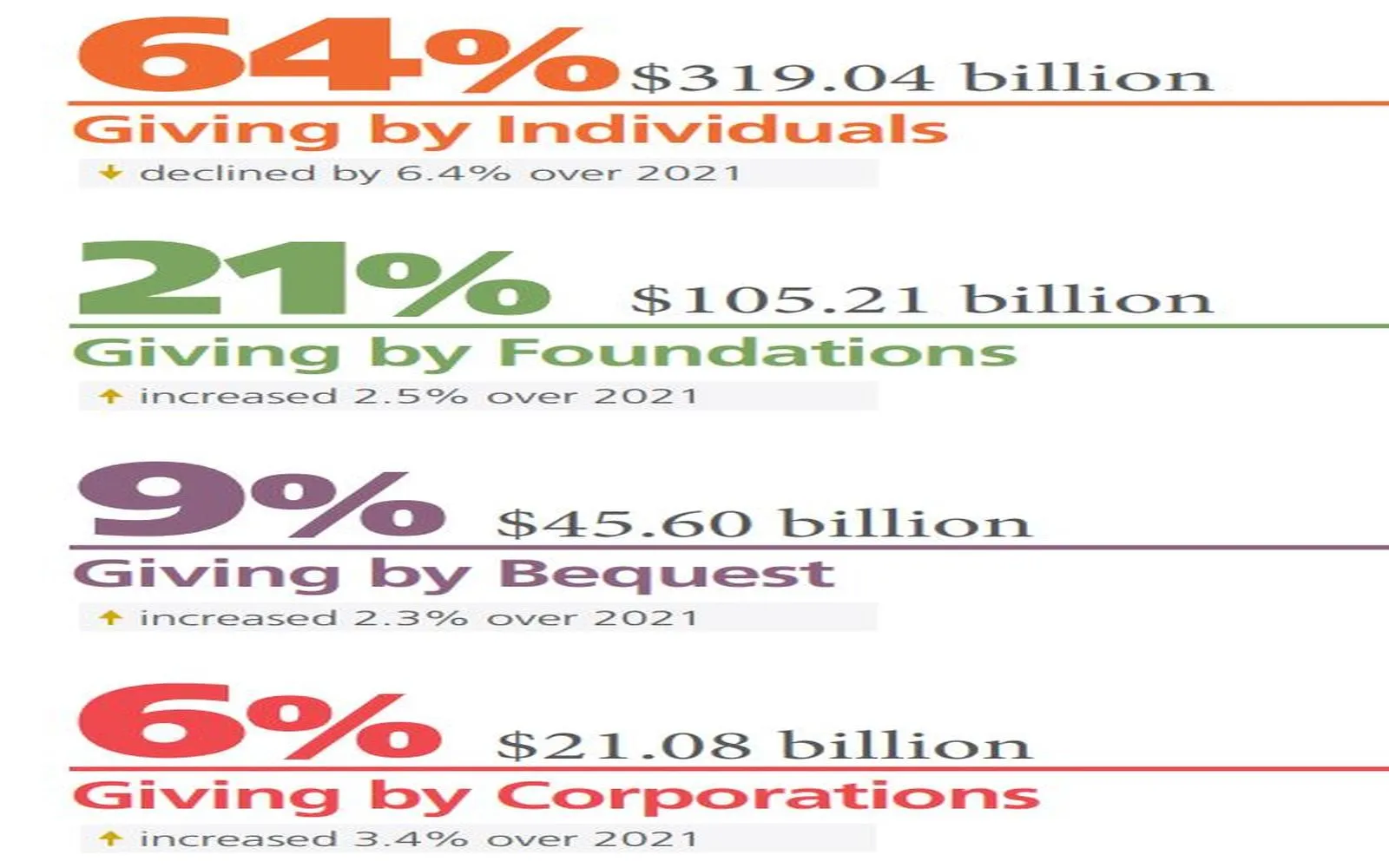

Donating in the USA: A Comprehensive Guide

Best Car Insurance Quotes 2025: A Comprehensive Guide

Best Commercial Vehicle Insurance in 2025: A Comprehensive Guide

Best Life Insurance 2025 in the USA

Understanding Humana Health Benefits

Donating in the USA: A Guide to Giving Back

The Best Internet Business Phone Systems: A Comprehensive Guide

How to Find a Good Slip and Fall Lawyer: A Comprehensive Guide