Understanding Pet Insurance: Protecting Your Furry Family Members

As pet owners, we strive to provide the best care for our animals, but unexpected health issues or accidents can quickly become costly. Just as we secure health insurance for ourselves, pet insurance offers the same protection for our furry companions. Whether it’s for routine veterinary visits, emergency surgeries, or chronic illnesses, having a good pet insurance plan can help you manage the financial burden of veterinary care. This article will guide you through what pet insurance is, how it works, and why it’s a wise investment for your pet’s health.

What is Pet Insurance?

Pet insurance is a policy designed to help cover the cost of veterinary bills in the event your pet gets sick or injured. Like human health insurance, pet insurance allows you to pay a monthly premium in exchange for coverage on certain medical expenses. While each plan differs, most policies help cover:

- Accidents and injuries

- Illnesses

- Surgical procedures

- Diagnostic tests

- Medications

- Chronic conditions

The level of coverage depends on the specific policy, which can range from basic coverage for emergencies to comprehensive plans that cover everything from wellness visits to advanced treatments.

Types of Pet Insurance

There are several types of pet insurance plans, each catering to different needs and budgets. Understanding these options can help you choose the best plan for your pet.

1. Accident-Only Coverage

This plan is the most basic and typically the least expensive. It covers injuries caused by accidents, such as broken bones, wounds, or poisoning, but it does not cover illnesses or preventive care. Accident-only plans are a good option for healthy pets that do not have any pre-existing conditions.

2. Time-Limited Coverage

Time-limited policies provide coverage for illnesses or injuries for a specified period, usually up to 12 months. After the coverage period expires, the policy will no longer pay for treatment related to that condition. These plans are often more affordable and can be suitable for pets that may only need short-term care.

3. Maximum Benefit Coverage

These plans cover specific conditions up to a set financial limit. Once the limit is reached, no further claims for that condition will be covered. While the premiums for these plans are typically higher than accident-only plans, they provide more comprehensive coverage for ongoing issues.

4. Lifetime Coverage

Lifetime policies offer the most extensive coverage, with no set time limit on the conditions covered. They provide protection for chronic illnesses and ongoing treatments for the life of the pet. While these policies are more expensive, they offer peace of mind for owners concerned about long-term health issues, such as diabetes or arthritis.

How Does Pet Insurance Work?

Pet insurance operates similarly to human health insurance in that you pay a monthly premium, and in return, the insurer helps cover your pet’s medical expenses. Here’s a basic breakdown of how it works:

- Premiums: You pay a monthly or annual premium to the insurance provider. The amount depends on factors such as your pet’s age, breed, and the level of coverage you choose.

- Deductibles: Most policies require you to pay a deductible before coverage kicks in. This is the amount you pay out-of-pocket for veterinary care before the insurer will begin reimbursing you.

- Reimbursement: After you’ve paid the deductible, the insurance provider reimburses you for a percentage of the veterinary costs. Typically, reimbursement rates range from 70% to 90% of the eligible expenses, depending on your plan.

- Exclusions: Pet insurance policies may have exclusions for certain treatments or pre-existing conditions. Be sure to read the terms and conditions carefully to understand what is and isn’t covered.

Benefits of Pet Insurance

1. Financial Peace of Mind

One of the primary reasons pet owners opt for insurance is to avoid unexpected and often high medical bills. Pet insurance can help alleviate the stress of covering expensive treatments, surgeries, or emergency care, giving you peace of mind that you won’t have to choose between your pet’s health and your finances.

2. Access to High-Quality Care

With pet insurance, you're more likely to provide your pet with the best care available, whether it’s for routine check-ups, diagnostics, or emergency treatments. Insurance can open doors to specialist care and advanced procedures that may otherwise be unaffordable.

3. Affordable Prevention

Many pet insurance plans now offer wellness or preventive care add-ons that cover routine check-ups, vaccinations, and flea/tick prevention. These additions help you maintain your pet’s overall health while preventing serious illnesses from developing.

4. Early Detection and Treatment

Insurance encourages early veterinary visits, which can help identify health issues before they become serious problems. This early intervention can improve your pet’s prognosis and potentially lower long-term treatment costs.

How Much Does Pet Insurance Cost?

The cost of pet insurance varies based on several factors, including:

- Pet’s Age: Older pets tend to have higher premiums due to the increased likelihood of health problems.

- Breed: Certain breeds are more prone to specific conditions, which can impact insurance rates.

- Location: The cost of veterinary care can vary by region, influencing premiums.

- Type of Coverage: Basic accident-only plans are cheaper, while comprehensive lifetime plans cost more.

On average, pet owners pay between $30 and $50 per month for a standard policy, though costs can be higher or lower depending on the aforementioned factors.

Conclusion

Pet insurance is a smart investment for anyone who wants to ensure their pet’s health is protected without breaking the bank. With the right policy, you can provide the care your furry companion needs throughout their life, whether it’s for routine checkups or more serious medical issues. Take the time to compare plans, understand what’s covered, and choose the best option for your pet’s health and your budget.

By securing pet insurance, you’re not only protecting your pet’s well-being but also enjoying peace of mind knowing that you’re prepared for whatever medical needs may arise.

Explore

Asbestos Lawsuit Lawyers: Protecting Your Rights and Pursuing Justice

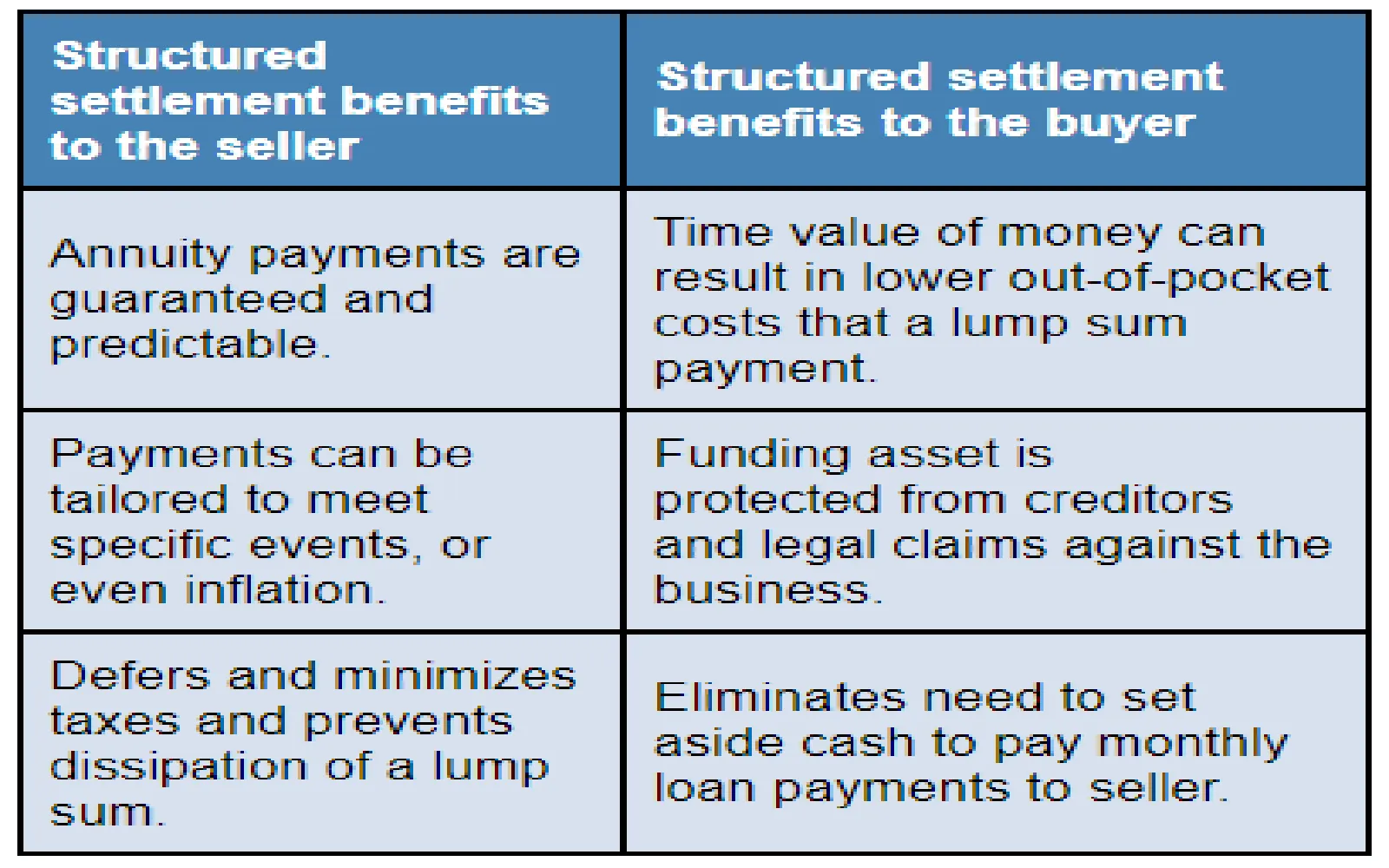

Understanding Structured Settlement Annuities: A Comprehensive Guide

Understanding Humana Health Benefits

Understanding Water Damage and How to Address It

Understanding Student Loans and How to Manage Them

Understanding Cloud Backup: The Future of Data Protection

Best Health Insurance in the USA: A Comprehensive Guide

Best Life Insurance 2025 in the USA