Understanding Student Loans and How to Manage Them

Student loans are a common way for many individuals to finance their higher education. However, managing these loans can be a significant financial burden after graduation. This article will explain the basics of student loans, the types available, and strategies for managing and paying them off.

🎓 What Are Student Loans?

Student loans are funds borrowed by students to help pay for their education expenses, including tuition, fees, room and board, and books. These loans are typically provided by the federal government or private lenders, and they must be repaid with interest.

💰 Types of Student Loans

There are two main types of student loans:

1. Federal Student Loans

These loans are provided by the U.S. Department of Education and typically offer lower interest rates and more flexible repayment options. The main types include:

- Direct Subsidized Loans: Available to undergraduate students with financial need. The government pays the interest while you’re in school.

- Direct Unsubsidized Loans: Available to both undergraduate and graduate students. Interest accrues while you're in school.

- Direct PLUS Loans: Available to graduate students and parents of undergraduate students. This loan type requires a credit check.

- Federal Perkins Loans: A federal loan offered to students with exceptional financial need (note that this program ended in 2017).

2. Private Student Loans

These loans are offered by private lenders like banks, credit unions, or online lenders. Private loans generally have higher interest rates and fewer repayment options compared to federal loans. They also often require a credit check and may need a co-signer.

📊 Interest Rates on Student Loans

The interest rate on student loans depends on the type of loan:

- Federal Loans: The interest rates for federal loans are fixed and are set annually by Congress. These rates are generally lower than private loan rates.

- Private Loans: The interest rates for private loans can be fixed or variable and depend on the borrower’s creditworthiness. These rates can vary widely.

📝 Repayment Plans

Federal student loans come with various repayment plans to help make repayment manageable, including:

1. Standard Repayment Plan

This plan has fixed monthly payments for up to 10 years. It’s the most straightforward option and works well for borrowers who can afford regular payments.

2. Income-Driven Repayment Plans

These plans calculate your monthly payment based on your income and family size. The options include:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

3. Extended Repayment Plan

This plan extends your repayment term to 25 years, lowering monthly payments, but you will pay more in interest over time.

4. Graduated Repayment Plan

This plan starts with lower payments that gradually increase every two years, making it ideal for borrowers who expect their income to rise over time.

5. Public Service Loan Forgiveness (PSLF)

This program offers loan forgiveness after 10 years of qualifying payments for borrowers working in public service jobs. It is only available for federal loans.

🧑💼 Managing Student Loans

Managing student loans effectively can help you avoid stress and financial strain after graduation. Here are some key tips:

1. Know Your Loan Types and Lenders

Understand which loans you have, the amounts, and the interest rates for each. This will help you prioritize repayment and avoid missed payments.

2. Stay On Top of Payments

Missing payments can lead to penalties, late fees, and damage to your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

3. Consider Refinancing or Consolidation

Refinancing or consolidating loans may help reduce your monthly payment by extending your loan term or getting a lower interest rate. However, refinancing federal loans may cause you to lose federal protections, such as income-driven repayment plans or loan forgiveness.

4. Make Extra Payments

Paying more than the minimum payment, even by a small amount, can help you pay off your loan faster and reduce the total interest paid over the life of the loan.

5. Seek Loan Forgiveness

If you work in a qualifying public service job, apply for Public Service Loan Forgiveness. Also, explore other forgiveness programs available for teachers, nurses, and other professions.

🚨 Common Student Loan Mistakes to Avoid

- Ignoring the Loans During School: Even if you are in school, it’s important to understand the terms and interest rates of your loans. The earlier you can start planning for repayment, the better.

- Paying the Minimum: Only paying the minimum can stretch out your loan repayment and increase the amount of interest you pay over time.

- Failing to Explore Repayment Options: Don’t just stick to one repayment plan. If you’re struggling, look into income-driven plans or deferment options.

- Not Seeking Help: If you're having trouble making payments, reach out to your loan servicer. They can offer guidance and options for deferring or lowering your payments.

💡 Conclusion

Student loans can feel overwhelming, but by understanding your loan options and repayment plans, you can make informed decisions and avoid common pitfalls. Whether you’re just starting your education or are about to graduate, the key to success is staying organized and proactive. Explore federal loan options, manage your loans efficiently, and take advantage of forgiveness programs when applicable to ensure you’re on track for financial success.

Explore

Understanding Water Damage and How to Address It

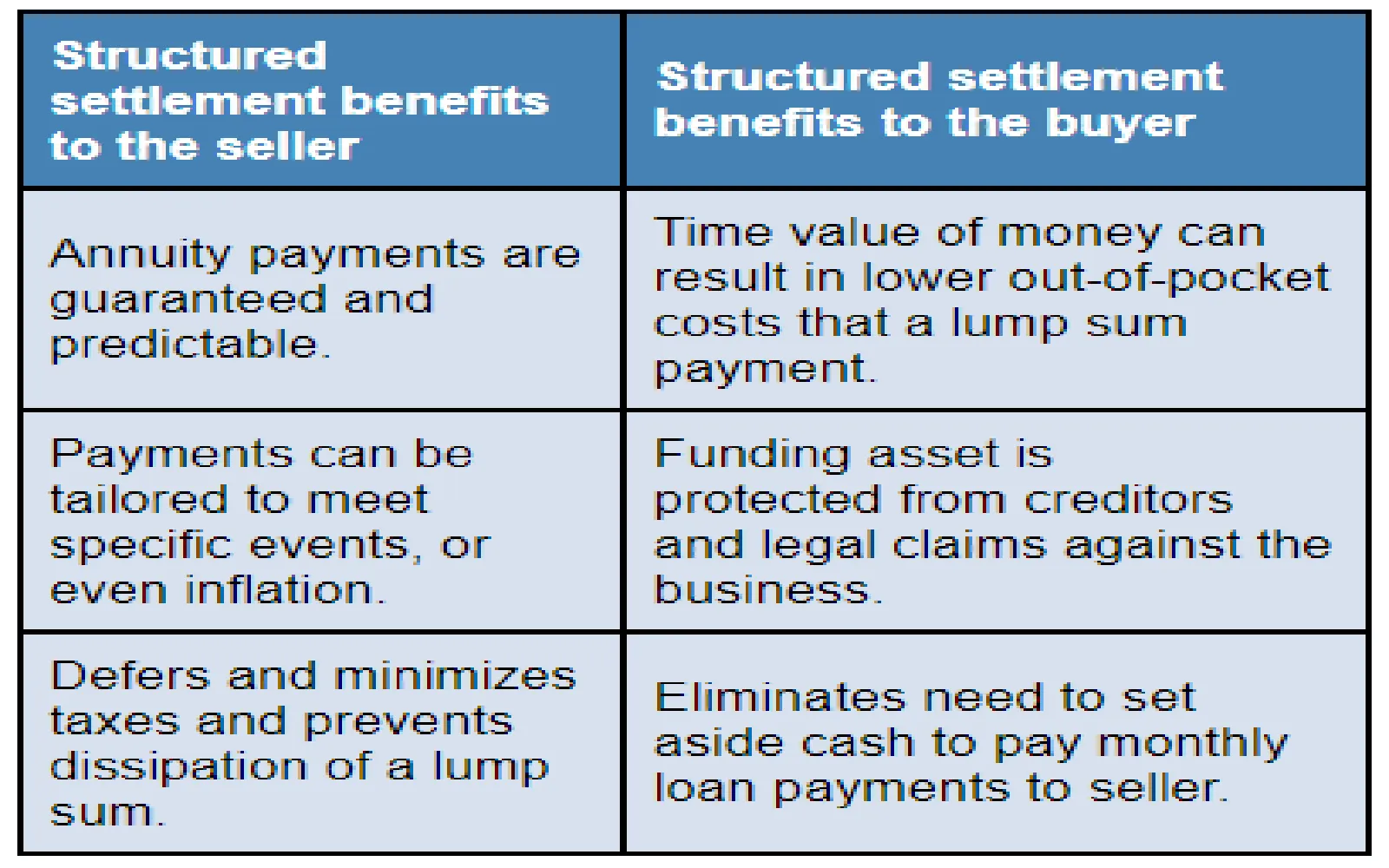

Understanding Structured Settlement Annuities: A Comprehensive Guide

Understanding Humana Health Benefits

Understanding Cloud Backup: The Future of Data Protection

Understanding Pet Insurance: Protecting Your Furry Family Members

Personal Loans for Debt Consolidation: A Smart Financial Move

Moving Company and Services: What to Expect and How to Choose the Right One

Top Network Security and Monitoring Software