Best Small Business Cash Advances in 2025: A Comprehensive Guide

As we move into 2025, small businesses are increasingly looking for flexible financing options to maintain growth and manage cash flow. One popular option is a small business cash advance, which allows businesses to borrow against future earnings. Unlike traditional loans, these advances provide quicker access to funds with less stringent credit requirements, making them an appealing solution for many entrepreneurs.

What is a Small Business Cash Advance?

A small business cash advance is a type of financing where a business receives a lump sum of money upfront in exchange for a percentage of future sales. Repayment is often tied directly to daily or weekly credit card sales, making it a more adaptable option than traditional loans.

These advances are typically used to cover short-term expenses, such as purchasing inventory, managing cash flow during slow periods, or funding marketing initiatives.

Key Factors to Consider When Choosing a Cash Advance

Before diving into our recommendations, it's important to understand what to look for in a small business cash advance. Here are some critical factors to keep in mind:

- Repayment Terms: Cash advances typically have shorter repayment periods, and the amount repaid is based on a percentage of your daily sales. Ensure the terms align with your business's cash flow.

- Advance Amount: Depending on your business’s revenue, cash advances can range from $5,000 to over $500,000. Be sure to select an advance that meets your financial needs without overextending your repayment capacity.

- Fees: Instead of interest rates, cash advances typically come with fixed fees known as factor rates. These rates generally range from 1.1 to 1.5, meaning for every $1,000 borrowed, you would pay back between $1,100 and $1,500.

- Speed of Funding: One of the primary benefits of cash advances is the speed of funding. Many lenders provide funds within 24–48 hours of approval.

- Eligibility: Cash advance providers often have more lenient eligibility requirements than traditional lenders. You may qualify even with poor credit, as long as your business has a steady revenue stream.

Best Small Business Cash Advance Providers in 2025

To help you make an informed decision, we've compiled a list of the best small business cash advance providers in 2025 based on the above criteria.

| Provider | Advance Amounts | Factor Rates | Funding Speed | Minimum Eligibility | Repayment Terms |

|---|---|---|---|---|---|

| Rapid Finance | $5,000 - $500,000 | 1.1 - 1.5 | 24 hours | 6 months in business, $5,000/month in sales | Daily/weekly |

| Fundbox | $10,000 - $150,000 | 1.2 - 1.4 | 1-2 days | 6 months in business, $50,000/year in sales | 12-24 weeks |

| PayPal Working Capital | $1,000 - $300,000 | 1.1 - 1.4 | Instant for PayPal users | PayPal sales required, $15,000/year (standard) | Percentage of PayPal sales |

| BlueVine | $5,000 - $250,000 | 1.2 - 1.5 | 24 hours | 6 months in business, $10,000/month in sales | Daily/weekly |

| Square Capital | $300 - $250,000 | 1.1 - 1.3 | Instant for Square users | Square account, consistent sales | Percentage of Square sales |

| National Funding | $5,000 - $500,000 | 1.15 - 1.5 | 24 hours | 6 months in business, $6,000/month in sales | Daily/weekly |

Detailed Overview of Top Providers

1. Rapid Finance

Rapid Finance is known for its flexibility and speed. They offer advances up to $500,000 with a relatively low factor rate, making it a solid choice for businesses with higher sales volumes. With funding available within 24 hours and minimal requirements, Rapid Finance is ideal for businesses needing quick access to cash.

2. Fundbox

Fundbox offers a cash advance product designed for smaller businesses or those that need short-term financial assistance. With a maximum advance of $150,000, their terms are competitive, and they boast a fast approval process. Fundbox requires a minimum of six months in business and $50,000 in annual sales, making it more accessible for newer businesses.

3. PayPal Working Capital

If your business processes a large volume of PayPal transactions, PayPal Working Capital is an excellent option. It offers advances up to $300,000 and ties repayment to your PayPal sales. This makes repayment more manageable during slow seasons, and the funds are available instantly for PayPal users.

4. BlueVine

BlueVine is a versatile option with a broad range of advance amounts and competitive factor rates. Their process is straightforward, and businesses can receive funds within 24 hours. BlueVine is ideal for businesses that generate at least $10,000 in monthly sales and have been operating for at least six months.

5. Square Capital

Square Capital is a popular option for businesses that use Square as their payment processor. They offer small and large advances with easy repayment terms—funds are automatically deducted as a percentage of your Square sales. The funds are available almost instantly for eligible Square users, making it one of the most convenient options.

6. National Funding

National Funding is known for offering substantial cash advances up to $500,000. They have a straightforward application process, and funds are available in as little as 24 hours. Their higher factor rates make it more expensive, but their large advances are perfect for businesses looking for significant capital injections.

Conclusion

Small business cash advances are a valuable tool for businesses that need quick and flexible access to capital. In 2025, several reputable providers offer competitive terms, fast funding, and relatively simple eligibility requirements, making it easier for small businesses to get the financing they need.

When choosing a cash advance, it's essential to consider your business's sales consistency, repayment capacity, and the specific terms offered by each provider. Carefully evaluate each option and choose the one that best aligns with your business goals.

Explore

The Best Internet Business Phone Systems: A Comprehensive Guide

Small Business Payroll Services in the USA 2025

Best Small Business Accounting Software in the USA (2025)

The Benefits of Using Simple CRM for Small Business

How to Find a Good Slip and Fall Lawyer: A Comprehensive Guide

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

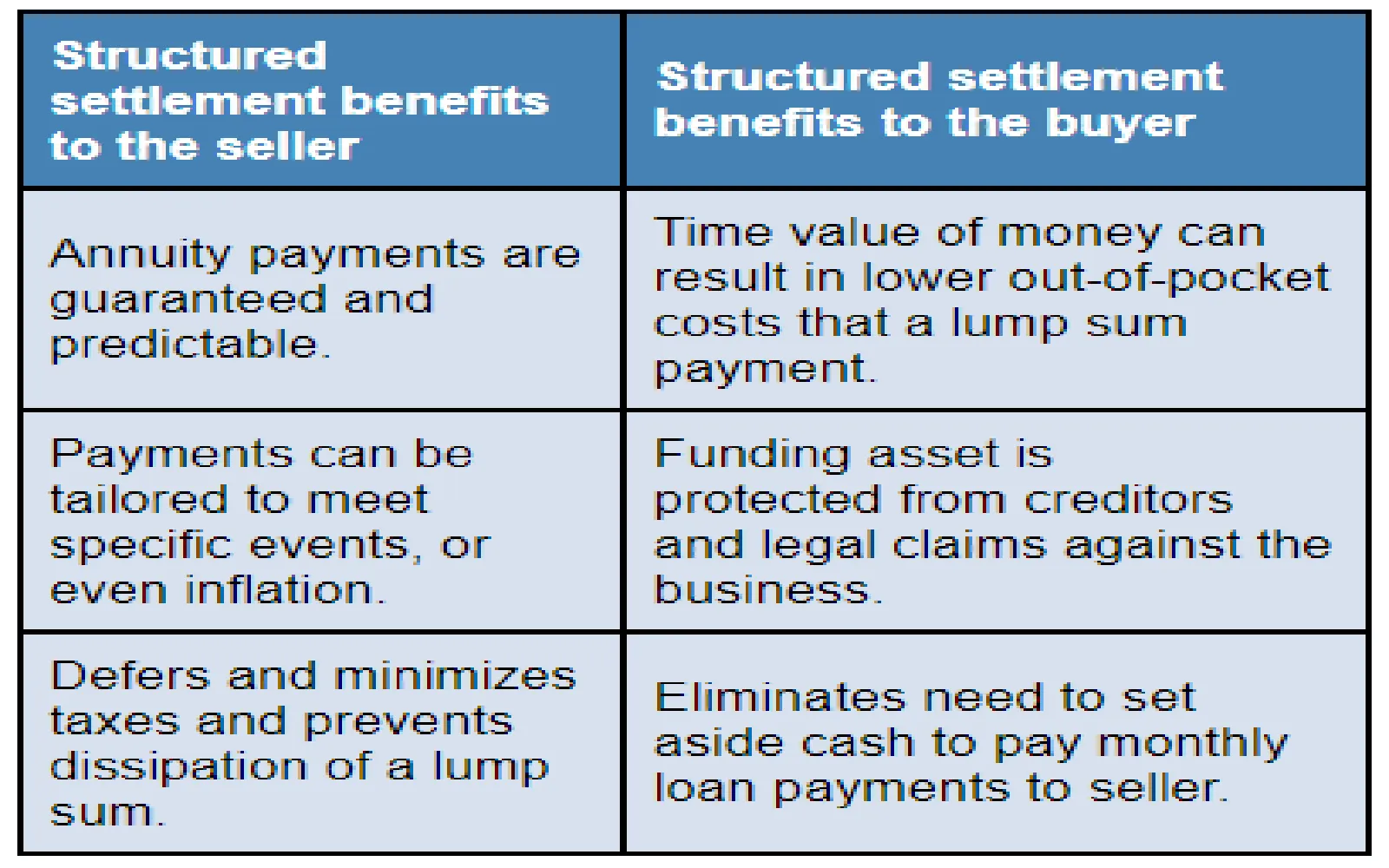

Understanding Structured Settlement Annuities: A Comprehensive Guide

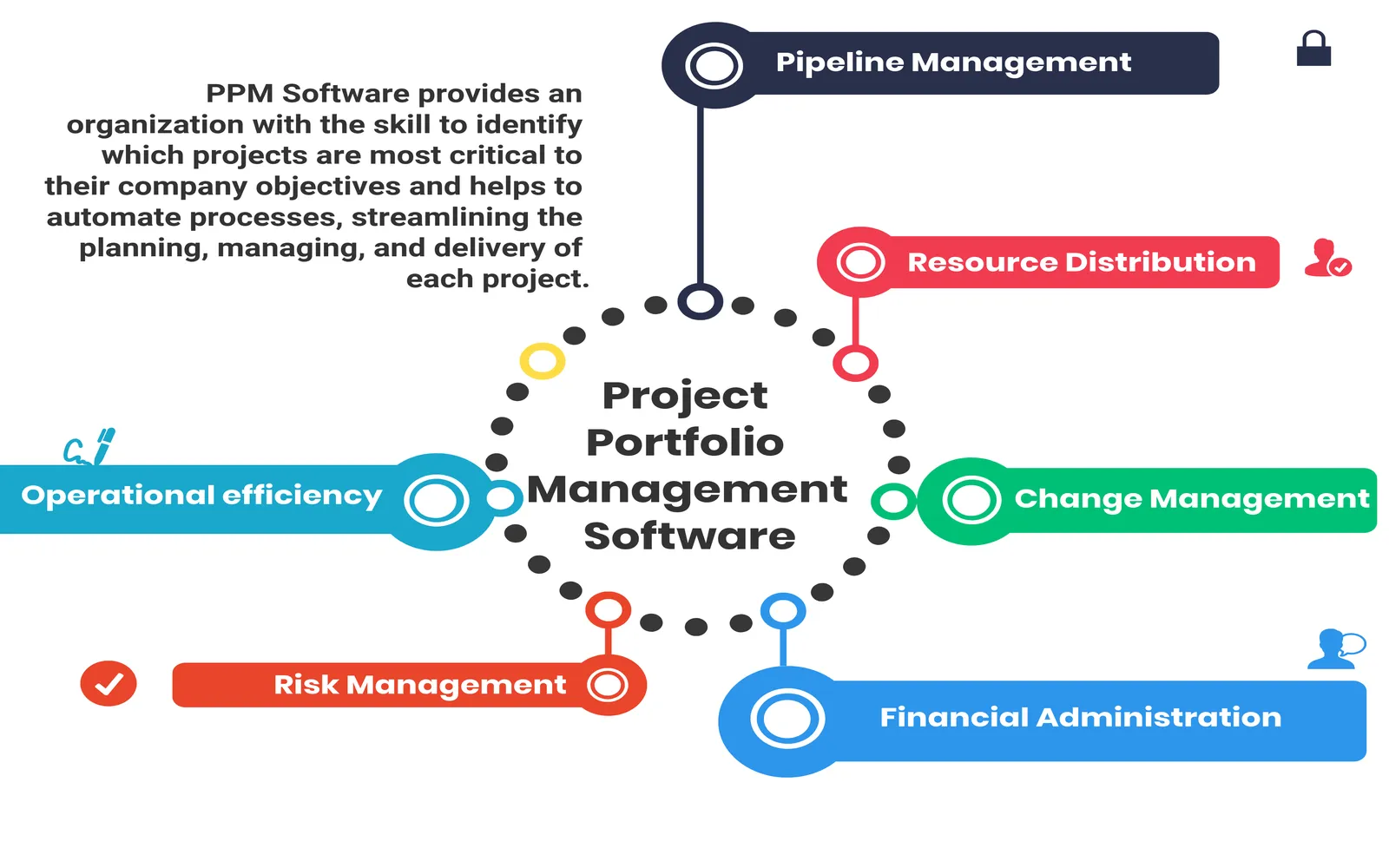

Best Project Portfolio Management Software: A Comprehensive Guide