Small Business Payroll Services in the USA 2025

As of 2025, payroll services for small businesses in the USA have become more advanced, customizable, and essential than ever before. The growing complexity of tax regulations, employee benefits, and compliance requirements has made handling payroll internally a challenge for many small businesses. With technology-driven solutions, businesses now have access to efficient and affordable payroll services that not only handle payroll but also offer HR services, tax filing, time tracking, and more. Here is an overview of the payroll services available in 2025.

What is Payroll Service?

Payroll services are external providers that help small businesses manage the process of paying employees. These services calculate wages, withhold taxes, and ensure that businesses comply with various state and federal regulations. Payroll services often come with additional features like managing benefits, handling direct deposits, and generating financial reports. They relieve small businesses of the administrative burden associated with employee compensation and help reduce the risk of penalties due to miscalculations or late payments.

Why Small Businesses Need Payroll Services

Small businesses face unique challenges when it comes to managing payroll. Without a dedicated HR or payroll department, owners and managers often find themselves juggling multiple roles. Payroll services allow small businesses to:

- Save Time: Automating payroll calculations, tax withholdings, and payment processes frees up time to focus on other aspects of business operations.

- Stay Compliant: Payroll services keep businesses up to date with the latest tax laws, filing deadlines, and wage requirements.

- Avoid Errors: Manual payroll processing increases the risk of errors, which can lead to tax penalties or dissatisfied employees.

- Offer Employee Benefits: Many payroll services also help small businesses manage employee benefits such as healthcare, retirement plans, and paid time off.

Key Features of Payroll Services in 2025

In 2025, payroll services are highly advanced, leveraging the latest technology and innovations to provide comprehensive solutions for small businesses. Some of the standout features include:

Cloud-Based Payroll Software

Cloud-based platforms allow businesses to manage payroll from anywhere with internet access. These platforms offer easy-to-use interfaces, making it simple for small businesses to handle payroll without the need for in-depth technical knowledge.

Automation

Most payroll services automate key processes such as payroll calculations, tax withholdings, and payments, significantly reducing the manual effort required. Automation also reduces the likelihood of human errors in payroll data.

Integration with Accounting Software

Payroll services often integrate with popular accounting software like QuickBooks, Xero, and FreshBooks, streamlining financial management and reducing duplicate data entry.

Tax Filing and Compliance

In 2025, payroll services automatically handle federal, state, and local tax filings, ensuring that businesses meet all tax obligations on time. Many providers also offer tax guarantee services, covering penalties for late or incorrect filings.

Employee Self-Service Portals

Many payroll providers offer portals where employees can view their pay stubs, tax forms, and benefits information. This reduces administrative work for small business owners and improves transparency for employees.

Popular Payroll Services for Small Businesses in the USA 2025

Below is a table showcasing some of the top payroll service providers for small businesses in the USA in 2025, highlighting their key features and pricing structures:

| Payroll Provider | Key Features | Pricing (Monthly) |

|---|---|---|

| Gusto | Full-service payroll, employee benefits, HR tools, tax filing | Starting at $45 base fee + $6 per employee |

| Paychex | Automated payroll, tax filings, time tracking, HR support | Starting at $39 base fee + $5 per employee |

| ADP | Scalable payroll services, benefits administration, HR support | Custom pricing based on business needs |

| QuickBooks Payroll | Integration with QuickBooks, automated tax filings, 24/7 support | Starting at $37.50 base fee + $4 per employee |

| OnPay | Unlimited payroll, tax filings, benefits administration | Flat fee of $40 base fee + $6 per employee |

Key Considerations for Choosing Payroll Services

When selecting a payroll service for your small business, consider the following factors:

- Cost: Pricing models vary among providers, so it's important to choose a service that fits your budget while meeting your payroll needs.

- Ease of Use: Look for platforms that are intuitive and easy to navigate. The goal is to streamline your payroll process, not complicate it.

- Compliance Support: Ensure the service you choose stays updated with federal and state tax regulations to avoid compliance issues.

- Scalability: As your business grows, your payroll needs will evolve. Choose a payroll service that can scale with your business.

Conclusion

In 2025, small businesses in the USA have a wide variety of payroll services to choose from, ranging from full-service providers to simple software solutions. These services not only simplify payroll but also help businesses stay compliant, manage employee benefits, and integrate with other essential business tools. With the right payroll service, small businesses can save time, avoid costly mistakes, and focus on growth.

Explore

What Is Payroll Software and Why Your Business Needs It

Best Small Business Accounting Software in the USA (2025)

Garage Door Repair Services in the USA: Ensuring Safety and Convenience

Best Small Business Cash Advances in 2025: A Comprehensive Guide

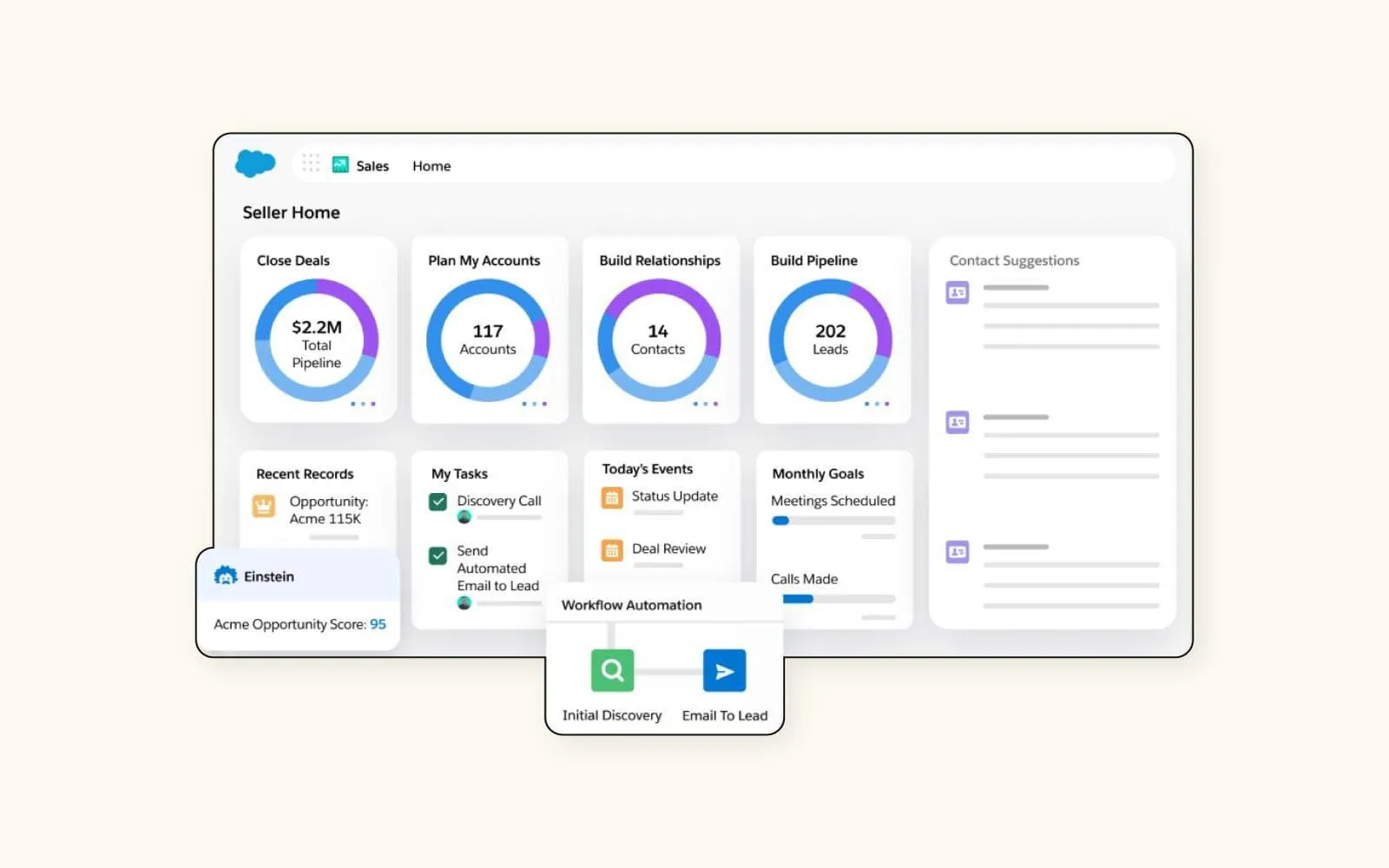

The Benefits of Using Simple CRM for Small Business

The Power of Press Release Services: A Vital Tool for Business Growth

Best Health Insurance in the USA: A Comprehensive Guide

Best Crossover SUVs of 2025 in the USA