The Best Financial Advisors of 2025: Your Guide to Smart Financial Planning

In 2025, financial advisory services have become more accessible and diverse, offering a wide range of options for people seeking to manage their finances, invest wisely, or plan for retirement. With technology enhancing the advisory landscape, there are now hybrid, robo-advisors, and traditional human advisors. Whether you're a seasoned investor or a novice, understanding which type of financial advisor is right for you is key to achieving your financial goals. In this article, we will explore the top financial advisors of 2025, categorized by their unique strengths and what they can offer.

Types of Financial Advisors

Before diving into the specific advisors, it's essential to understand the types of advisors available in 2025:

- Traditional Human AdvisorsThese are certified professionals like Certified Financial Planners (CFPs) or Chartered Financial Analysts (CFAs) who provide personalized advice based on your financial situation and goals. They usually offer one-on-one consultations and tailor plans specific to your needs.

- Robo-AdvisorsRobo-advisors use algorithms and automation to manage your investments. They are cost-effective and ideal for people looking for basic, hands-off investment solutions with minimal human interaction. The technology behind these platforms has advanced significantly in 2025, offering more sophisticated portfolio management and planning tools.

- Hybrid AdvisorsHybrid advisors combine the best of both worlds: you get access to algorithm-driven portfolio management, but also the option to consult with human advisors for personalized advice. This option is great for people who want a mix of cost-efficiency and human insight.

| Type of Advisor | Best For | Services Offered | Cost |

|---|---|---|---|

| Traditional Human Advisors | Personalized, in-depth financial advice | Retirement planning, estate planning, tax advice, investments | High (Hourly or flat fee, commission-based) |

| Robo-Advisors | Low-cost, automated investment management | Portfolio management, retirement accounts (IRAs, 401(k)s), tax-loss harvesting | Low (Annual management fee, typically 0.25%-0.5%) |

| Hybrid Advisors | A blend of automation and human expertise | Portfolio management, financial planning, optional human advisor consultations | Moderate (Annual management fee + advisor fees) |

Top Financial Advisors in 2025

1. Vanguard Personal Advisor Services

- Type: Hybrid

- Best For: Retirement planning and long-term investment strategies.

- Why It’s Great: Vanguard is a giant in the world of investing, known for its low-cost mutual funds and ETFs. Vanguard Personal Advisor Services offer human financial advisors alongside its robo-advisory platform. With an annual fee of 0.30%, clients get access to personalized financial plans from a Certified Financial Planner.

- Cost: 0.30% annual management fee.

- Strengths: Low cost, personalized human advice, access to Vanguard’s funds.

2. Betterment

- Type: Robo-Advisor

- Best For: Beginners and tech-savvy investors looking for an affordable, hands-off approach.

- Why It’s Great: Betterment continues to be one of the best robo-advisors in 2025, offering fully automated portfolio management with a focus on tax efficiency and goal-setting tools. It’s easy to use, with an annual fee of 0.25%, making it ideal for new investors or those with simpler needs.

- Cost: 0.25% annual management fee.

- Strengths: Simple interface, tax-loss harvesting, no minimum balance.

3. Schwab Intelligent Portfolios Premium

- Type: Hybrid

- Best For: Investors looking for a mix of automation and human advice with premium services.

- Why It’s Great: Charles Schwab’s robo-advisor offers automated investment management but also allows users to upgrade to its premium service for unlimited access to certified financial planners. With a one-time planning fee of $300 and $30/month thereafter, it’s a cost-effective option for those who want ongoing financial advice.

- Cost: $300 one-time fee + $30/month.

- Strengths: Low ongoing fees, human advisor access, comprehensive financial planning.

4. Personal Capital

- Type: Hybrid

- Best For: High-net-worth individuals looking for wealth management services.

- Why It’s Great: Personal Capital stands out for its combination of free financial tools and wealth management services. While you can use its free software to track investments, cash flow, and net worth, those with over $100,000 in investable assets can access their wealth management services, which include human advisors.

- Cost: 0.89% for accounts up to $1 million.

- Strengths: Comprehensive wealth management, free financial tools, tailored investment strategy.

5. Ellevest

- Type: Robo-Advisor

- Best For: Women-focused investing and financial planning.

- Why It’s Great: Ellevest is one of the few robo-advisors designed with women’s financial needs in mind. It provides investment strategies and financial planning that factor in salary gaps, career breaks, and longer life expectancy. With a mission to close the gender wealth gap, it’s a top choice for women in 2025.

- Cost: 0.25%-0.50% annual management fee.

- Strengths: Women-focused, personalized financial strategies, impact investing.

How to Choose the Best Financial Advisor for You

Choosing the right financial advisor in 2025 depends on several factors, including your financial goals, budget, and preferred level of involvement. If you want hands-off investment management at a low cost, a robo-advisor like Betterment or Ellevest might be ideal. If you need more personalized financial advice, consider a hybrid option like Vanguard or Schwab Intelligent Portfolios. For high-net-worth individuals, wealth management services like Personal Capital offer comprehensive planning and human interaction.

In 2025, the range of financial advisors has expanded, offering tailored solutions for all types of investors, whether you're just starting or managing millions in assets. With advances in technology, even the most hands-on investors can benefit from affordable, automated tools that maximize their financial outcomes. Choose the option that aligns with your goals, and you'll be on the path to financial success.

Explore

Personal Loans for Debt Consolidation: A Smart Financial Move

Maximizing Your Tax Return: A Guide to Boosting Your Refund

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

Data Protection: A Guide to Safeguarding Your Information

The Best Internet Business Phone Systems: A Comprehensive Guide

Top MBA Distance Education Programs: An In-Depth Guide

How to Find a Good Slip and Fall Lawyer: A Comprehensive Guide

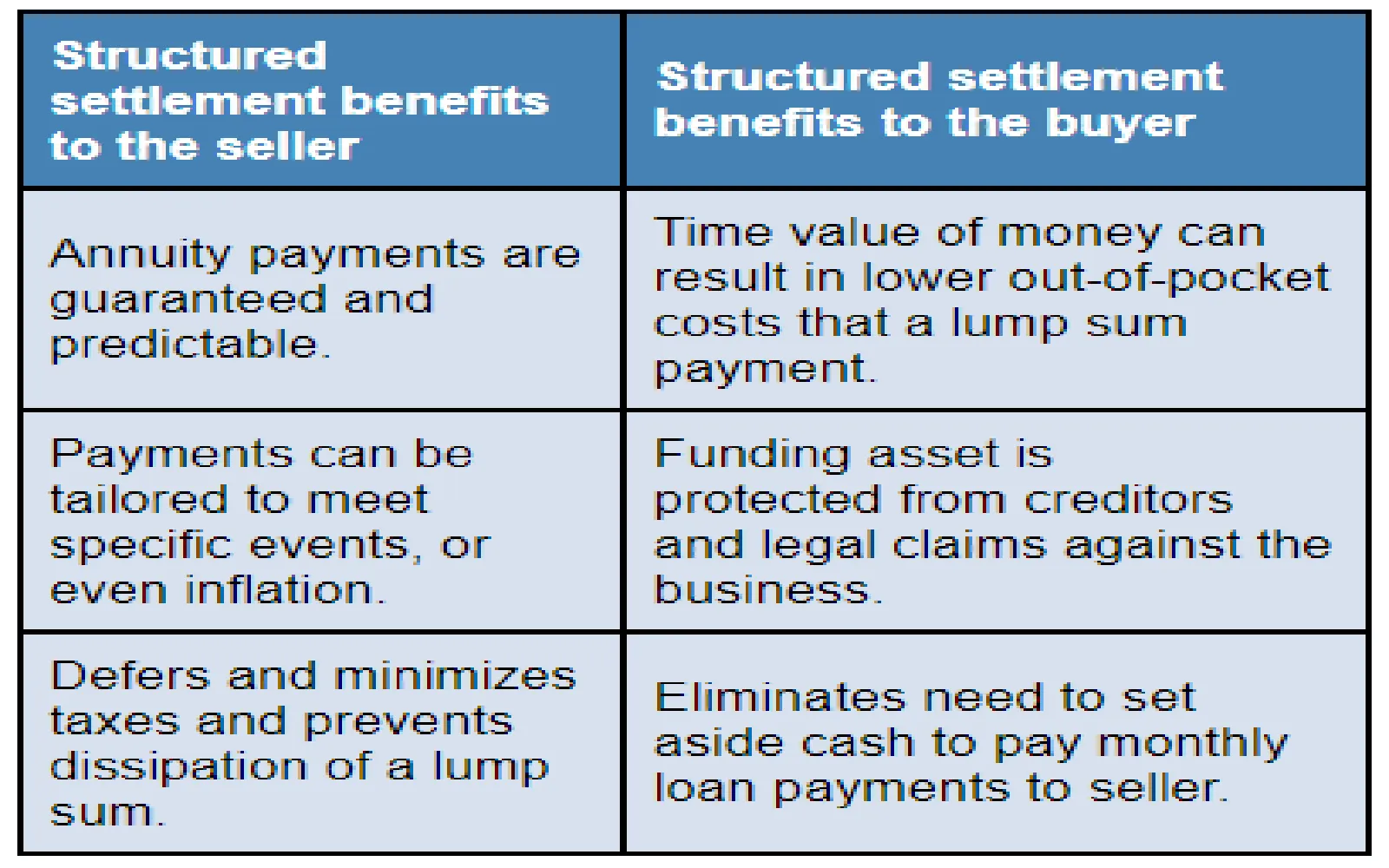

Understanding Structured Settlement Annuities: A Comprehensive Guide