Best Travel Credit Cards of 2025: Top Picks for Earning Rewards on Your Adventures

Traveling the world can be a dream come true, and with the right credit card, you can make the most of your journey by earning rewards, enjoying travel benefits, and even saving money on purchases. In 2025, credit card issuers are offering a wide variety of options to travelers, with benefits ranging from airport lounge access to enhanced earning potential on travel-related purchases. Whether you're a frequent flyer or an occasional vacationer, there's a travel credit card for you. Here’s a breakdown of the best travel credit cards for 2025, their features, and who they’re best for.

1. Chase Sapphire Preferred® Card

Best For: Earning Points on Travel & Dining

The Chase Sapphire Preferred® Card has long been a favorite for travelers, thanks to its great earning potential and redemption flexibility. The card earns 2x points on travel and dining and 1x point on all other purchases. The bonus points you can earn with this card are also attractive—current offers often include 60,000 points after you spend $4,000 in the first 3 months.

Key Benefits:

- 2x points on travel and dining

- 25% more value when redeeming points through Chase Ultimate Rewards

- No foreign transaction fees

- Primary rental car insurance

- 60,000 bonus points (worth $750 in travel)

Annual Fee: $95

2. The Platinum Card® from American Express

Best For: Premium Travel Perks & Luxury Benefits

For those looking for luxury and top-tier travel perks, the Platinum Card® from American Express is hard to beat. Although it comes with a high annual fee, the wealth of benefits—such as access to over 1,200 airport lounges worldwide—makes it one of the top contenders for premium travelers.

Key Benefits:

- 5x points on flights booked directly with airlines or through American Express Travel

- 5x points on prepaid hotels booked through Amex Travel

- Access to the American Express Global Lounge Collection

- Up to $200 in airline fee credits annually

- No foreign transaction fees

Annual Fee: $695

3. Capital One Venture Rewards Credit Card

Best For: Simple & Straightforward Rewards

The Capital One Venture Rewards Credit Card is ideal for those who want to earn easy-to-understand rewards. With 2x miles on every purchase and the ability to redeem miles for travel expenses, this card is perfect for travelers who want simplicity and flexibility.

Key Benefits:

- 2x miles on every purchase

- 5x miles on hotels and rental cars booked through Capital One Travel

- Up to $100 credit for Global Entry or TSA PreCheck

- Flexible redemption options, including flights, hotel stays, and car rentals

Annual Fee: $95

4. Citi Premier® Card

Best For: Earning on Travel, Dining, & Entertainment

The Citi Premier® Card offers generous rewards on a range of categories, including travel, dining, and entertainment. With 3x points on restaurants, supermarkets, and streaming services, this card is ideal for individuals who spend heavily in those categories.

Key Benefits:

- 3x points on travel, restaurants, supermarkets, and streaming services

- 2x points on all other purchases

- No foreign transaction fees

- 60,000 bonus points after spending $4,000 in the first 3 months

Annual Fee: $95

5. American Express® Gold Card

Best For: Dining Rewards & Everyday Spending

If you’re a foodie who loves to earn points on dining out, the American Express® Gold Card is one of the best options for 2025. It offers 4x points at restaurants, including takeout and delivery, as well as 3x points on flights booked directly with airlines.

Key Benefits:

- 4x points on dining at restaurants, including takeout and delivery

- 3x points on flights booked directly with airlines

- $120 annual dining credit ($10/month)

- No foreign transaction fees

Annual Fee: $250

6. Bank of America® Travel Rewards Credit Card

Best For: No Annual Fee & Flat Rewards

If you're looking for a simple travel card with no annual fee, the Bank of America® Travel Rewards Credit Card is an excellent option. This card offers a flat 1.5x points on all purchases, which can be redeemed for travel-related expenses.

Key Benefits:

- 1.5x points on every purchase

- No annual fee

- No foreign transaction fees

- 25,000 bonus points after spending $1,000 in the first 90 days (worth $250 in travel)

Annual Fee: $0

7. Wells Fargo Autograph® Card

Best For: Earning on a Variety of Categories

The Wells Fargo Autograph® Card is perfect for those who want to earn rewards on a wide range of spending categories. With 3x points on dining, travel, gas, streaming services, and more, it’s a versatile card that earns significant rewards on your everyday expenses.

Key Benefits:

- 3x points on dining, travel, gas, streaming, and more

- 1x point on all other purchases

- $200 sign-up bonus after spending $1,000 in the first 3 months

- No annual fee

Annual Fee: $0

Travel Credit Cards Comparison Table:

| Card Name | Key Earning Rates | Annual Fee | Sign-up Bonus | Best For |

|---|---|---|---|---|

| Chase Sapphire Preferred® Card | 2x points on travel & dining, 1x on other purchases | $95 | 60,000 points (worth $750 in travel) | Earning points on travel & dining |

| The Platinum Card® from American Express | 5x points on flights & prepaid hotels, 1x on other purchases | $695 | 100,000 points (worth $1,000 in travel) | Premium travel perks & luxury benefits |

| Capital One Venture Rewards | 2x miles on every purchase, 5x on hotels & rental cars | $95 | 75,000 miles (worth $750 in travel) | Simple & flexible rewards |

| Citi Premier® Card | 3x points on travel, restaurants, supermarkets, and streaming | $95 | 60,000 points (worth $600 in travel) | Earning on a variety of categories |

| American Express® Gold Card | 4x points on dining, 3x points on flights | $250 | 60,000 points (worth $600 in travel) | Dining rewards & everyday spending |

| Bank of America® Travel Rewards | 1.5x points on every purchase | $0 | 25,000 points (worth $250 in travel) | Simple, no annual fee, flat rewards |

| Wells Fargo Autograph® Card | 3x points on dining, travel, gas, streaming, etc. | $0 | $200 bonus after spending $1,000 in 3 months | Earning on a wide variety of categories |

Conclusion:

In 2025, there are plenty of travel credit cards to choose from, each with its unique set of benefits. Whether you prioritize earning points on dining and travel, access to premium lounges, or no annual fee, there's a card for every type of traveler. The Chase Sapphire Preferred® Card is an excellent all-around option for frequent travelers, while the Platinum Card® from American Express stands out for those who value luxury perks. For simpler options with no annual fee, consider the Bank of America® Travel Rewards Credit Card or the Wells Fargo Autograph® Card. Choose the card that aligns best with your travel habits to maximize your rewards and perks in 2025.

Explore

How to Get a Travel Insurance Quote Online

Travel with Confidence: Exploring the Benefits of Travelocity

Maximizing Your Tax Return: A Guide to Boosting Your Refund

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

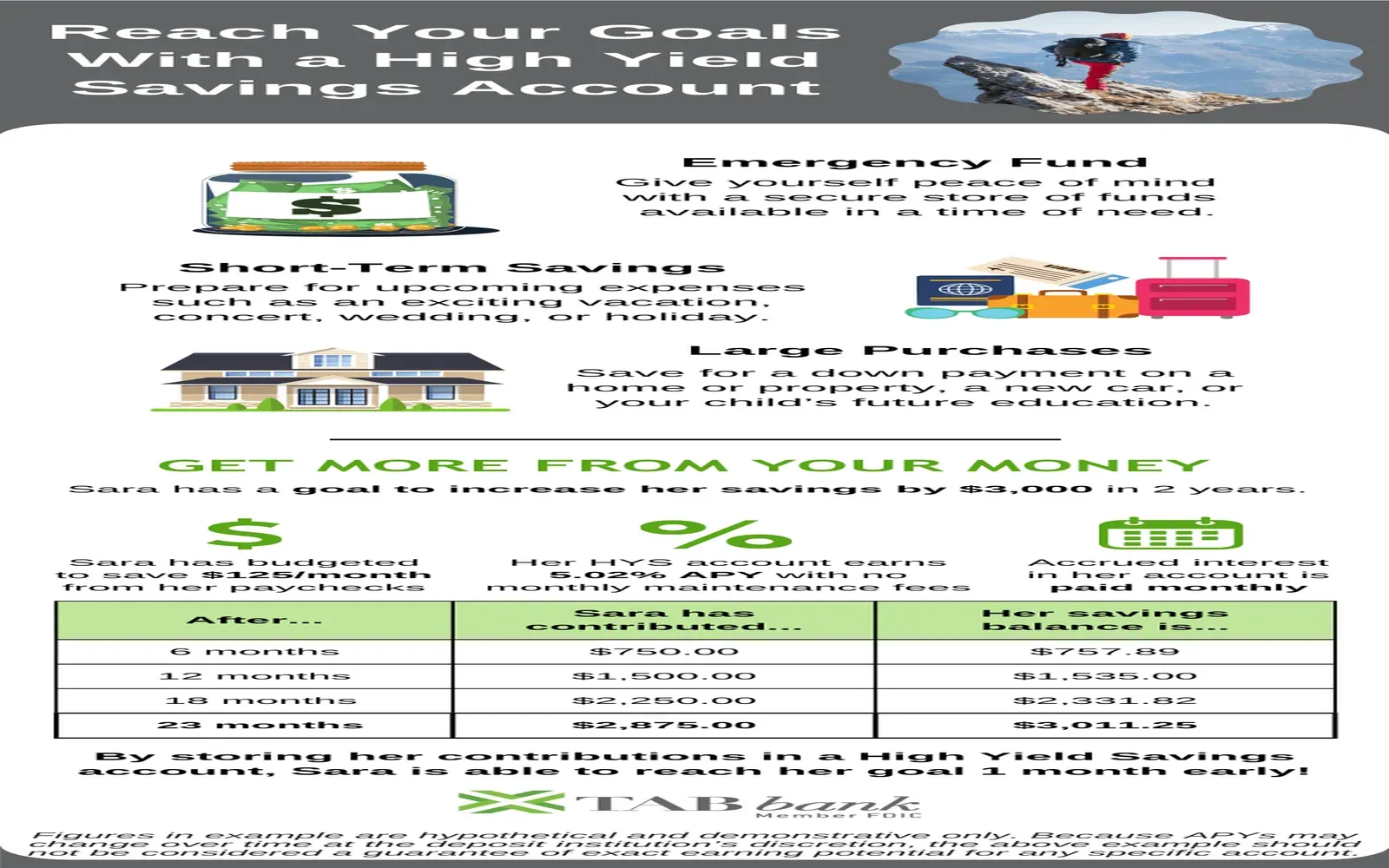

Best High-Yield Savings Accounts of 2025: Maximizing Your Savings Potential

The Best Financial Advisors of 2025: Your Guide to Smart Financial Planning

What Is Payroll Software and Why Your Business Needs It

Finding the Right Local Law Firm for Your Legal Needs