Best High-Yield Savings Accounts for 2025

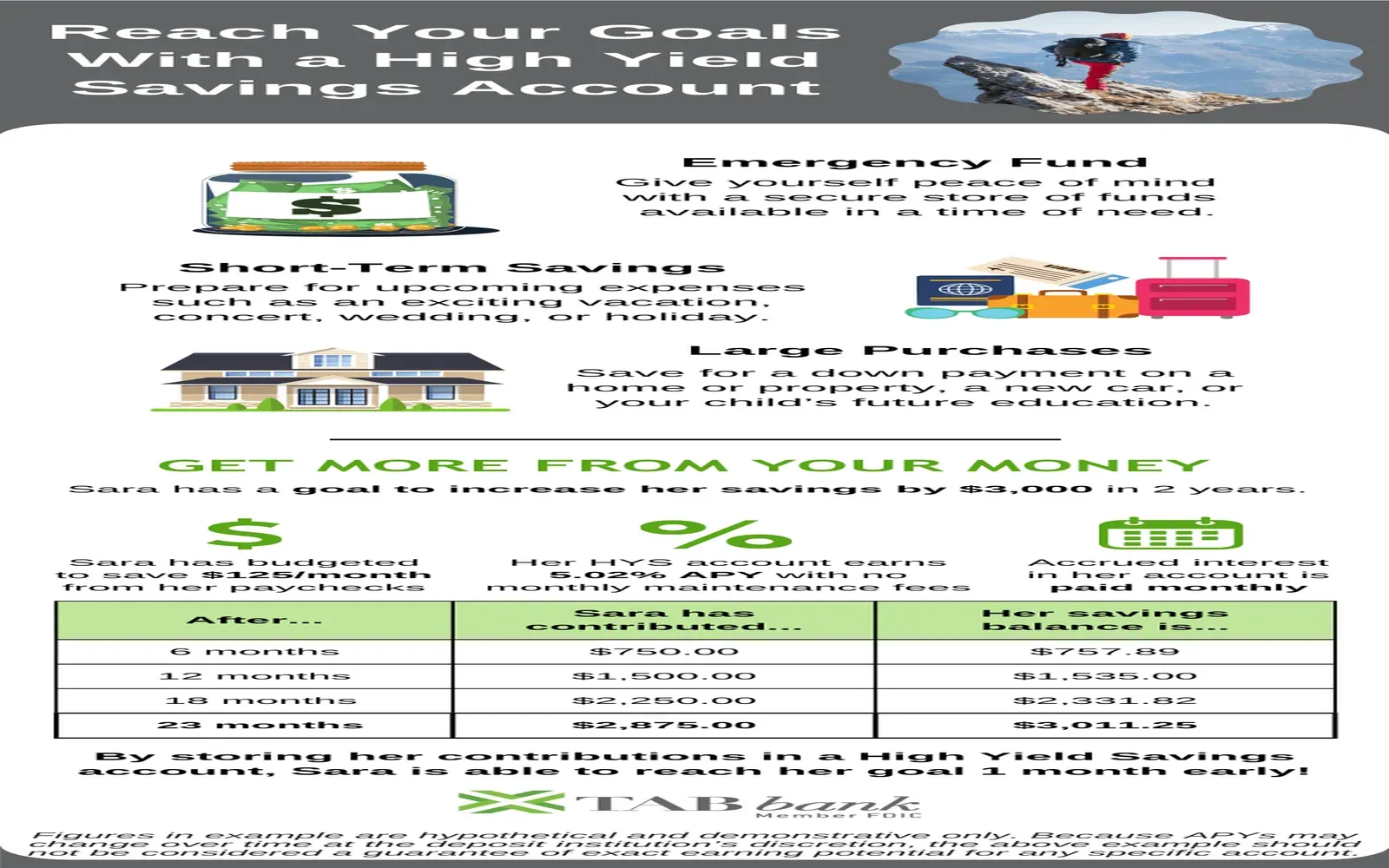

A high-yield savings account (HYSA) offers a much better interest rate than traditional savings accounts, making it an attractive option for savers who want to grow their money with minimal risk. With many financial institutions competing for your business, finding the best high-yield savings account is crucial to maximizing your savings potential. In this article, we’ll explore the top high-yield savings accounts available for 2025.

What is a High-Yield Savings Account?

A high-yield savings account is similar to a traditional savings account, but with a higher interest rate. These accounts are typically offered by online banks or credit unions, which can afford to pay higher interest rates due to their lower operating costs. High-yield savings accounts are FDIC-insured (or NCUA-insured for credit unions), meaning your money is safe up to $250,000 per depositor, per institution.

Top High-Yield Savings Accounts for 2025

1. Ally Bank High-Yield Savings Account

- APY: 4.00%

- Minimum Deposit: $0

- Monthly Fees: None

- Pros: Ally Bank offers one of the best interest rates in the market with no minimum balance requirement. Their online platform is user-friendly, and they provide 24/7 customer support.

- Cons: While Ally Bank offers competitive rates, it’s an online-only bank, so there are no physical branches.

2. Marcus by Goldman Sachs High-Yield Online Savings Account

- APY: 3.90%

- Minimum Deposit: $0

- Monthly Fees: None

- Pros: Marcus is known for its strong reputation and reliable customer service. There are no fees and no minimum deposit required to start earning a high interest rate.

- Cons: While Marcus offers a high APY, they don’t provide checking accounts or ATM access, limiting some of their banking options.

3. Discover Bank High-Yield Savings Account

- APY: 3.75%

- Minimum Deposit: $0

- Monthly Fees: None

- Pros: Discover Bank offers a strong APY and provides a range of banking services, including a checking account and access to over 60,000 ATMs nationwide.

- Cons: Some users may find the online platform less intuitive than others.

4. Capital One 360 Performance Savings

- APY: 3.75%

- Minimum Deposit: $0

- Monthly Fees: None

- Pros: Capital One 360 provides an easy-to-use mobile app and offers no fees, no minimum balance, and access to Capital One’s network of ATMs.

- Cons: Although the APY is competitive, it’s not the highest compared to some other online banks.

5. CIT Bank Savings Builder Account

- APY: 4.25% (if you meet requirements)

- Minimum Deposit: $100

- Monthly Fees: None

- Pros: CIT Bank offers a very high APY, and it’s available to customers who either make a deposit of at least $100 per month or maintain a balance of $25,000. Their mobile app is highly rated.

- Cons: The APY requires a higher balance or consistent monthly deposits to achieve the top rate.

6. Synchrony Bank High-Yield Savings Account

- APY: 4.00%

- Minimum Deposit: $0

- Monthly Fees: None

- Pros: Synchrony Bank offers competitive interest rates and has no monthly maintenance fees. Customers also get access to over 100,000 ATMs.

- Cons: Synchrony does not offer a mobile app, so some users may find managing their account more difficult compared to other banks.

Factors to Consider When Choosing a High-Yield Savings Account

1. Interest Rate (APY)

The interest rate is the primary reason people choose high-yield savings accounts. Look for the highest APY to maximize your earnings, but remember that rates can change over time.

2. Fees

Check for any hidden fees, such as maintenance fees or withdrawal fees, that can eat into your earnings. Most high-yield savings accounts offer no monthly fees, but it’s always good to confirm.

3. Minimum Deposit Requirements

Some banks require a minimum deposit to open an account. If you’re just starting to save, choose an account with no minimum deposit requirement.

4. Access to Funds

Consider how easily you can access your funds. Some high-yield savings accounts offer ATM access or mobile apps for easy transfers, while others may have limited access.

5. FDIC Insurance

Ensure that the bank offers FDIC insurance (or NCUA insurance for credit unions), which guarantees that your deposits are protected up to $250,000.

How to Maximize Your Earnings in a High-Yield Savings Account

- Automate Deposits: Set up automatic transfers to regularly contribute to your high-yield savings account. This helps grow your savings consistently and ensures you don’t miss any opportunities to earn interest.

- Look for Promotions: Some banks offer bonuses for new customers or high initial deposits. Take advantage of these offers when available.

- Avoid Withdrawals: While high-yield savings accounts allow you to access your funds, withdrawing too frequently can prevent your savings from growing. Try to avoid withdrawing unless necessary.

Conclusion

High-yield savings accounts are a great way to earn more from your savings without taking on any investment risk. By choosing an account with a competitive interest rate, no fees, and convenient features, you can grow your savings faster. Always shop around for the best rates and be mindful of any minimum balance requirements or fees that may apply. Whether you’re saving for a short-term goal or building an emergency fund, a high-yield savings account can help you maximize your earnings with minimal effort.

Explore

Best High-Yield Savings Accounts of 2025: Maximizing Your Savings Potential

The Importance of Hiring the Best Criminal Defense Attorney

The Best Internet Business Phone Systems: A Comprehensive Guide

Top MBA Distance Education Programs: An In-Depth Guide

The Power of Press Release Services: A Vital Tool for Business Growth

Top Network Security and Monitoring Software

How to Find a Good Slip and Fall Lawyer: A Comprehensive Guide

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt